Spx Options Calendar Spread

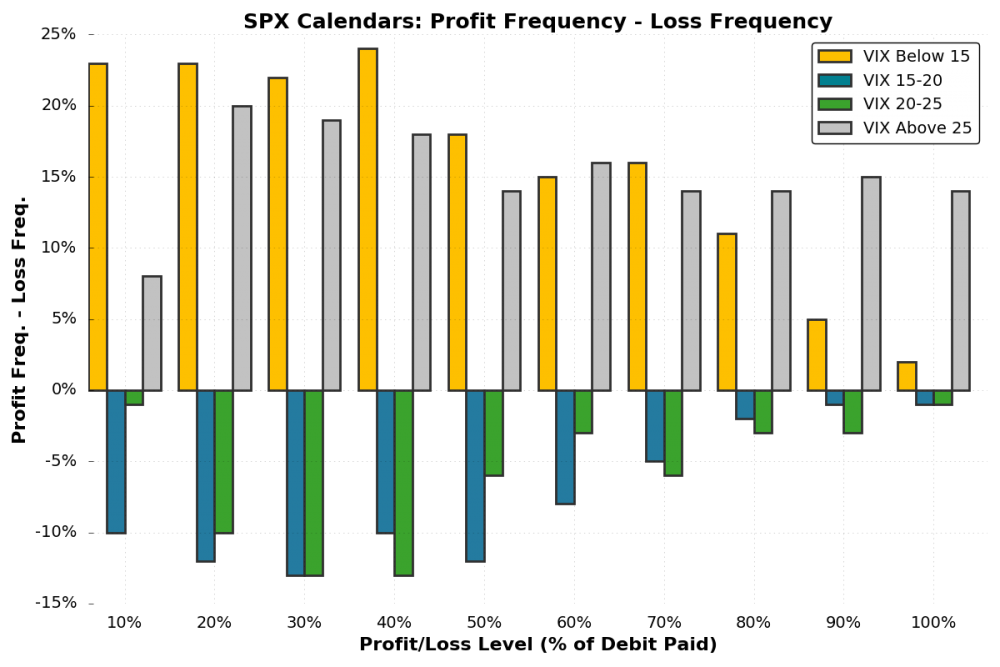

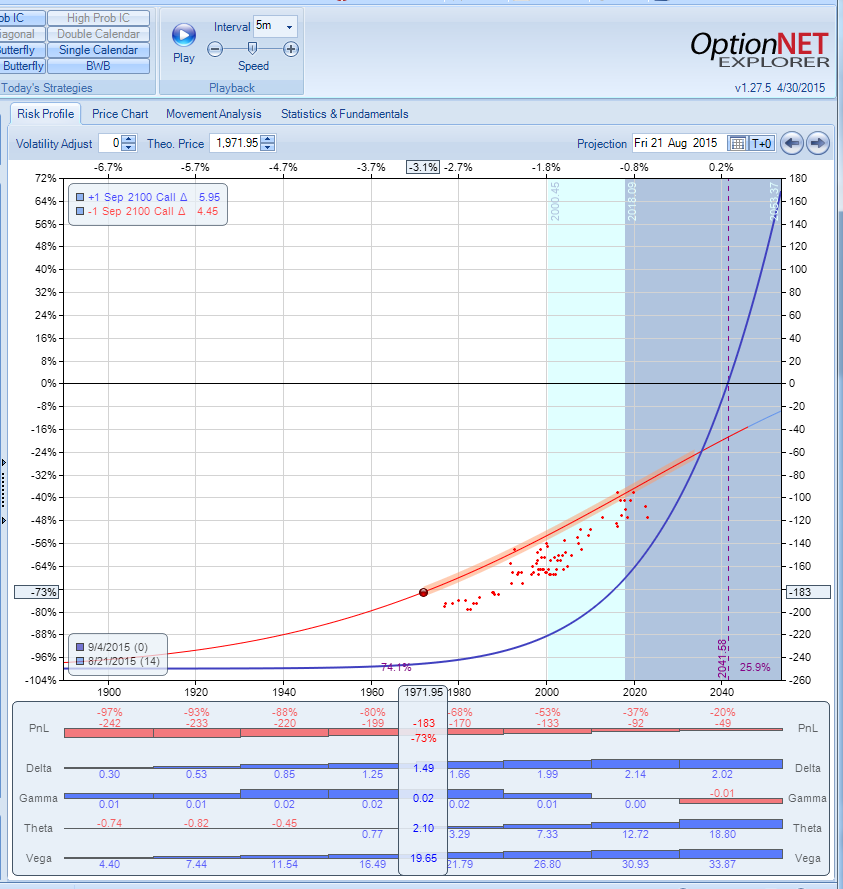

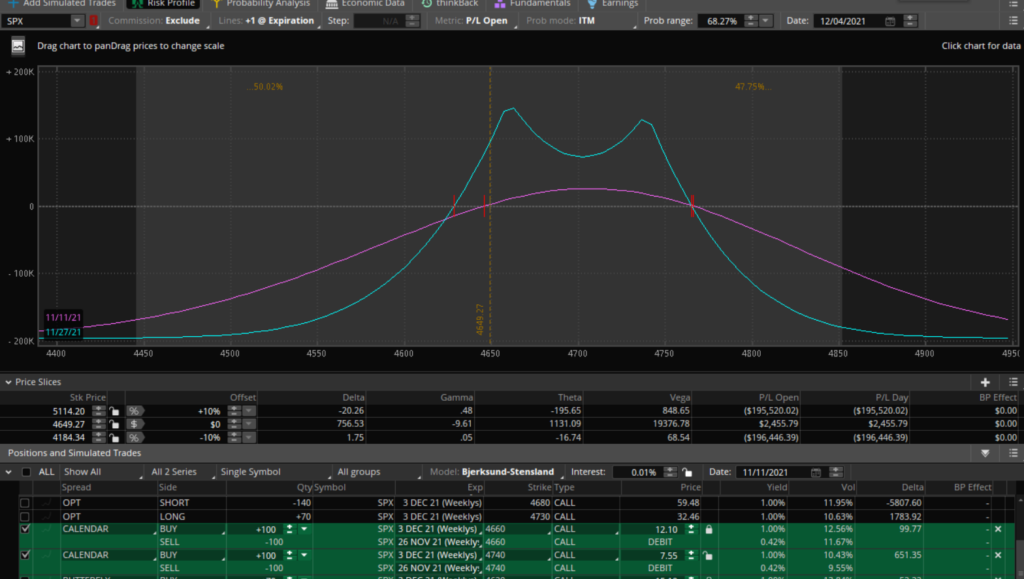

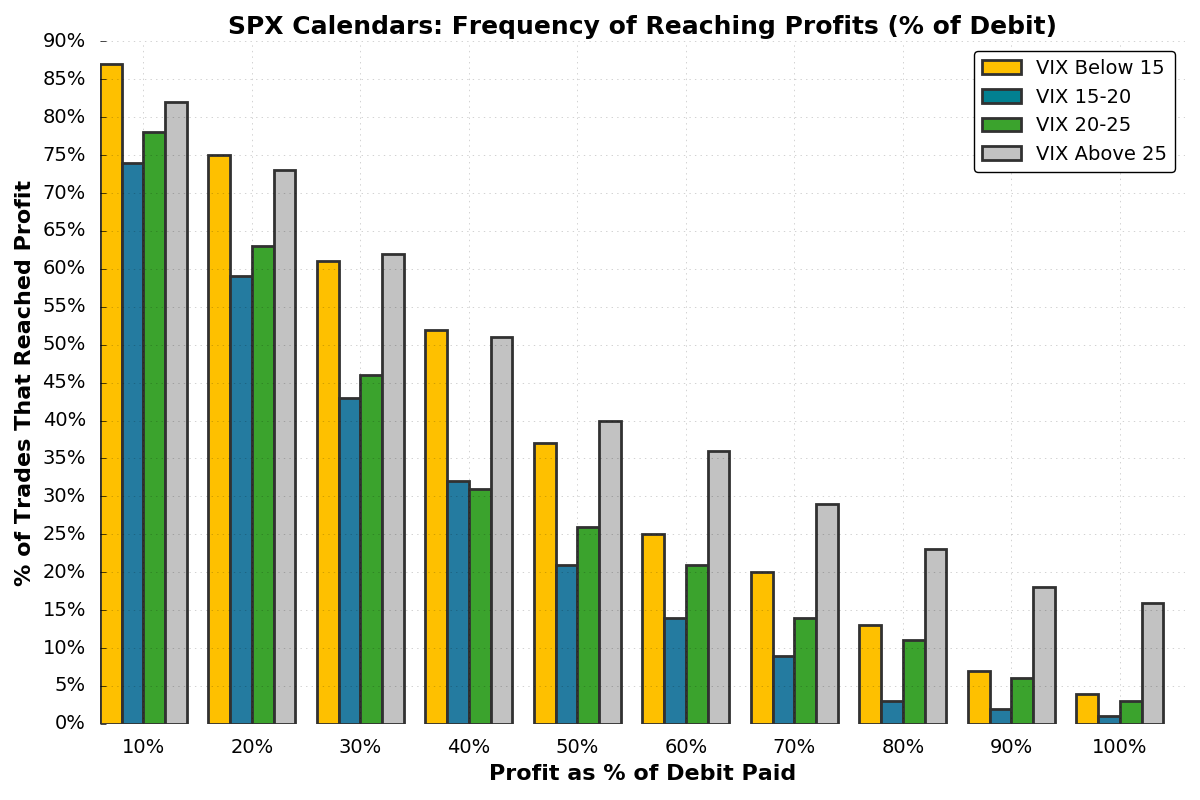

Spx Options Calendar Spread - Options credit spreads involve selling an option at a. Study our spx calendar spread example to learn more, or visit steadyoptions' large article base. The idea behind such a hybrid trade is to benefit from certain. Discover the top 5 spx index options strategies to maximize profits, including 0dte, iron condors, credit spreads, protective puts, and calendar spreads. Calculate potential profit, max loss, chance of profit, and more for calendar put spread options and over 50 more strategies. Learn when and how to use. These benefits stem from the. Let’s assume, that i am looking for a call calendar spread because i think. Calendar spreads allow traders to construct a trade that minimizes the effects of time. He also talks about option income strategies desig. Options credit spreads involve selling an option at a. In this article, i would like to show you how to scan (and be alerted) for cheap spx calendar spreads. Learn when and how to use. Calculate potential profit, max loss, chance of profit, and more for calendar put spread options and over 50 more strategies. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. The idea behind such a hybrid trade is to benefit from certain. This article is about calendar spreads and how to trade spx options. I suspect your breakevens are around 3500 and 3800 (without looking at charts), so if the spot is outside that range, then you. Study our spx calendar spread example to learn more, or visit steadyoptions' large article base. Let’s assume, that i am looking for a call calendar spread because i think. While spy and spx options might track the same market, their contract sizes. You will see what i mean by the following example of an spx trade that is already in. The idea behind such a hybrid trade is to benefit from certain. Calendar spreads allow. Option trading veteran and power cycle trading®founder larry gaines explains calendar call option spreads. Learn when and how to use. He also talks about option income strategies desig. The idea behind such a hybrid trade is to benefit from certain. In this article, i would like to show you how to scan (and be alerted) for cheap spx calendar spreads. Let’s assume, that i am looking for a call calendar spread because i think. The spx falls way below 3560 or rises much higher than 3750. While spy and spx options might track the same market, their contract sizes. This article is about calendar spreads and how to trade spx options. We will place the calendar for the butterfly at. Below is an approximation of the values of a call calendar spread vs. Option trading veteran and power cycle trading®founder larry gaines explains calendar call option spreads. Calculate potential profit, max loss, chance of profit, and more for calendar put spread options and over 50 more strategies. The idea behind such a hybrid trade is to benefit from certain. They. Learn when and how to use. Below is an approximation of the values of a call calendar spread vs. They are most profitable when the underlying asset does not change much until after the. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. In this article, we’ll cover. This article is about calendar spreads and how to trade spx options. The idea behind such a hybrid trade is to benefit from certain. Learn when and how to use. These benefits stem from the. The spx falls way below 3560 or rises much higher than 3750. Learn when and how to use. Let’s assume, that i am looking for a call calendar spread because i think. He also talks about option income strategies desig. The spx falls way below 3560 or rises much higher than 3750. Discover the top 5 spx index options strategies to maximize profits, including 0dte, iron condors, credit spreads, protective puts, and. Options credit spreads involve selling an option at a. Study our spx calendar spread example to learn more, or visit steadyoptions' large article base. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The spx falls way below 3560 or rises much higher than 3750. He also talks about option income strategies desig. Option trading veteran and power cycle trading®founder larry gaines explains calendar call option spreads. You will see what i mean by the following example of an spx trade that is already in. I’ve compared the 2 strategies over a 1 week period of time. In this article, i would like to show you how to scan (and be alerted) for. In this article, i would like to show you how to scan (and be alerted) for cheap spx calendar spreads. We will place the calendar for the butterfly at the long leg of the threatened lower wing. Study our spx calendar spread example to learn more, or visit steadyoptions' large article base. He also talks about option income strategies desig.. The idea behind such a hybrid trade is to benefit from certain. These benefits stem from the. Options credit spreads involve selling an option at a. In this article, i would like to show you how to scan (and be alerted) for cheap spx calendar spreads. I trade a lot of calendar spreads, and was looking to build a trade setup using 0dte calendar spreads in spx for daily trades. This article is about calendar spreads and how to trade spx options. Discover the top 5 spx index options strategies to maximize profits, including 0dte, iron condors, credit spreads, protective puts, and calendar spreads. They are most profitable when the underlying asset does not change much until after the. He also talks about option income strategies desig. While spy and spx options might track the same market, their contract sizes. You will see what i mean by the following example of an spx trade that is already in. In this case study, i want to share a recent spx options trade in which i combined calendar and diagonal spreads. In this article, we’ll cover five essential metrics you should evaluate before entering a new options credit spread on the spx. Calendar spreads allow traders to construct a trade that minimizes the effects of time. Study our spx calendar spread example to learn more, or visit steadyoptions' large article base. Option trading veteran and power cycle trading®founder larry gaines explains calendar call option spreads.SPX Calendar Spread How I Made a 540 Profit with Options Trading

Short Term Calendars in SPX Dan Sheridan YouTube

SPX 15 Day Calendar Spread Calm Hedge

SPX calendar spread YouTube

SPX Calendar Spread Calendar Spread Profit and Loss

Combining Calendar Spreads with Butterfly Spreads SPX Options YouTube

Double Calendar Spread in SPX YouTube

Calendar Call Option Spread [SPX] YouTube

SPX Calendar Spread Calendar Spread Profit and Loss

How to Trade SPX Options SPX Calendar Spread Example

I’ve Compared The 2 Strategies Over A 1 Week Period Of Time.

We Will Place The Calendar For The Butterfly At The Long Leg Of The Threatened Lower Wing.

I Suspect Your Breakevens Are Around 3500 And 3800 (Without Looking At Charts), So If The Spot Is Outside That Range, Then You.

Below Is An Approximation Of The Values Of A Call Calendar Spread Vs.

Related Post:

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)