Spy Leaps Calendar Spread

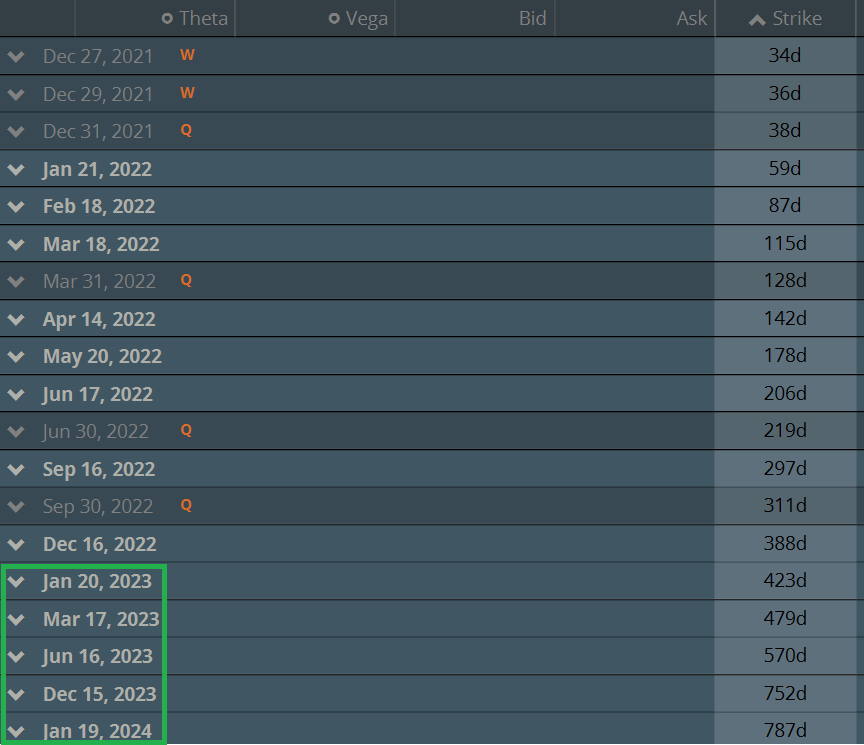

Spy Leaps Calendar Spread - Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against the leaps. Since spy is a representation of the stocks in the s&p 500, the higher percentage gains with leaps can allow investors to beat the market significantly. While this hedges the written calls, brokerage firms do not consider them to. You can buy a leaps any time. Spy moves up to 161 so an adjustment is needed. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. Leaps calendars are just like standard calendars, except that the back. In this post we will focus on long calendar. Simple, both theta and vega are positive with this play. This means that your position will benefit from the passage of time and/or an increase in volatility. Watch to see how i do it! It's easier to predict the market in 3 months than it is 2 years. Covered calls aren’t calendar spreads. Simple, both theta and vega are positive with this play. By successfully selling enough near dated options, an efficient calendar. Both diagonals and calendars are excellent tools for lowering the cost basis of a longer dated option. While this hedges the written calls, brokerage firms do not consider them to. What are leaps calendar or time spreads and why should you care? There are two key structural. Here's an easy example with spy. What are leaps calendar or time spreads and why should you care? Here we take a look at the rationale for leaps based calendar spreads and examine the two big structural advantages. Here's an easy example with spy. This means that your position will benefit from the passage of time and/or an increase in volatility. You don’t have to open. Here we take a look at the rationale for leaps based calendar spreads and examine the two big structural advantages. You can buy a leaps any time. It's easier to predict the market in 3 months than it is 2 years. Though gains are made in all, spy leaps move efficient, lower bid ask spread as time. A calendar spread. You don’t have to open both positions at once, right? Instead of writing covered calls against shares of stock, you can use leaps options as a proxy and repeatedly write near dated call options against the leaps. But, call is to be written only when the leaps is in the money. Here's an easy example with spy. Since spy is. If we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining life and selling options that will expire the very next day. Though gains are made in all, spy leaps move efficient, lower bid ask spread as time. Buy spy may/june 158c calendar with spy at. Buy spy may/june 158c calendar with spy at 158 at 1.17 debit with a target of 1.40. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. There are two key structural. Discover 5 ways to use spy leaps calendar spread for options trading, including. Leaps calendars are just like standard calendars, except that the back. Here we take a look at the rationale for leaps based calendar spreads and examine the two big structural advantages. What are leaps calendar or time spreads and why should you care? You can buy a leaps any time. A calendar spread is what we call the options trade. Spy moves up to 161 so an adjustment is needed. Since spy is a representation of the stocks in the s&p 500, the higher percentage gains with leaps can allow investors to beat the market significantly. Here we take a look at the rationale for leaps based calendar spreads and examine the two big structural advantages. Buy spy may/june 158c. In this article, we will learn methods #3 and #4 for adjustments involving leaps and double calendars. Buy spy may/june 158c calendar with spy at 158 at 1.17 debit with a target of 1.40. There are two key structural. Simple, both theta and vega are positive with this play. You alluded to the standard delta for long leaps, so a. Watch to see how i do it! Leaps calendars are just like standard calendars, except that the back. Discover 5 ways to use spy leaps calendar spread for options trading, including volatility, hedging, and income strategies, to maximize profits and minimize risk in financial markets with. When executed for a debit (i.e., cash comes out of. Both diagonals and calendars. It's easier to predict the market in 3 months than it is 2 years. But, call is to be written only when the leaps is in the money. In this video i show you how and why i am constructing and placing a calendar spread option strategy in $spy (spy). There are two key structural. Maximize trading profits with the. Watch to see how i do it! What are leaps calendar or time spreads and why should you care? Though gains are made in all, spy leaps move efficient, lower bid ask spread as time. If we think it will fluctuate less than a dollar, the best move is to buy calendar spreads, buying options with 8 days of remaining life and selling options that will expire the very next day. Here's an easy example with spy. A calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. Spy moves up to 161 so an adjustment is needed. You can make 3 month money over and over, adjusting your price and trade size as the world changes. Covered calls aren’t calendar spreads. Simple, both theta and vega are positive with this play. Buy spy may/june 158c calendar with spy at 158 at 1.17 debit with a target of 1.40. Both diagonals and calendars are excellent tools for lowering the cost basis of a longer dated option. While this hedges the written calls, brokerage firms do not consider them to. In this video i show you how and why i am constructing and placing a calendar spread option strategy in $spy (spy). This means that your position will benefit from the passage of time and/or an increase in volatility. A calendar spread involves simultaneously buying and selling options with the same strike price but different expiration months.SPY Bullish Calendar Spread YouTube

NFX and SPY Calendar Spreads YouTube

Constructing The LEAPS Perpetual Strategy

Options Interest Group ppt download

SPY Calendar Spread Option Strategy YouTube

LEAP Options Explained Definition and Examples projectfinance

Options Interest Group ppt download

💥SPY LEAPS Strategy 2022 💥100 win rate for 2021💥 YouTube

Calendar Spread AdjustmentsSPY YouTube

Leaps 2024 Calendar Spread Live Trade Update YouTube

Discover 5 Ways To Use Spy Leaps Calendar Spread For Options Trading, Including Volatility, Hedging, And Income Strategies, To Maximize Profits And Minimize Risk In Financial Markets With.

Here We Take A Look At The Rationale For Leaps Based Calendar Spreads And Examine The Two Big Structural Advantages.

Since Spy Is A Representation Of The Stocks In The S&P 500, The Higher Percentage Gains With Leaps Can Allow Investors To Beat The Market Significantly.

When Executed For A Debit (I.e., Cash Comes Out Of.

Related Post:

.jpg)