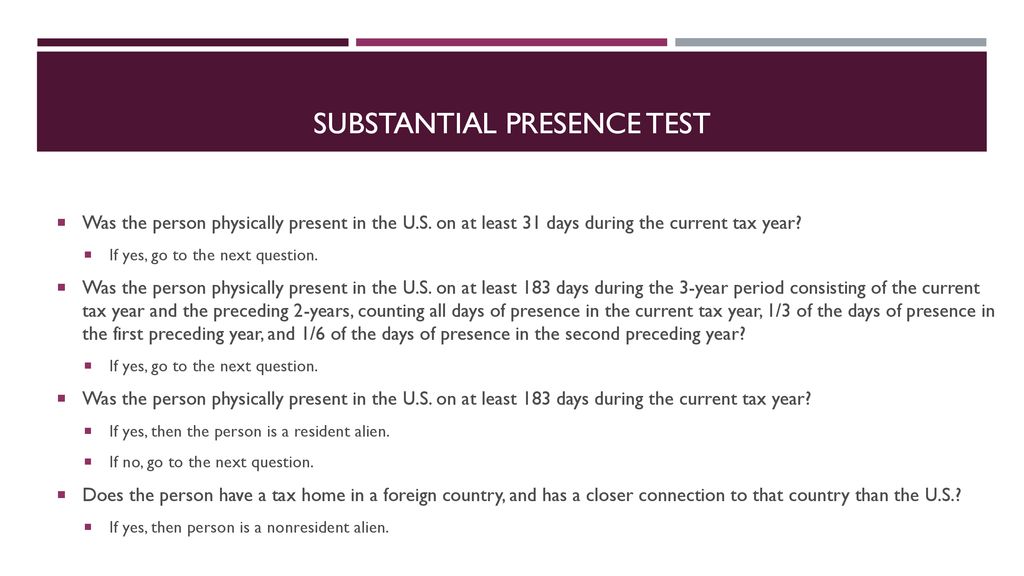

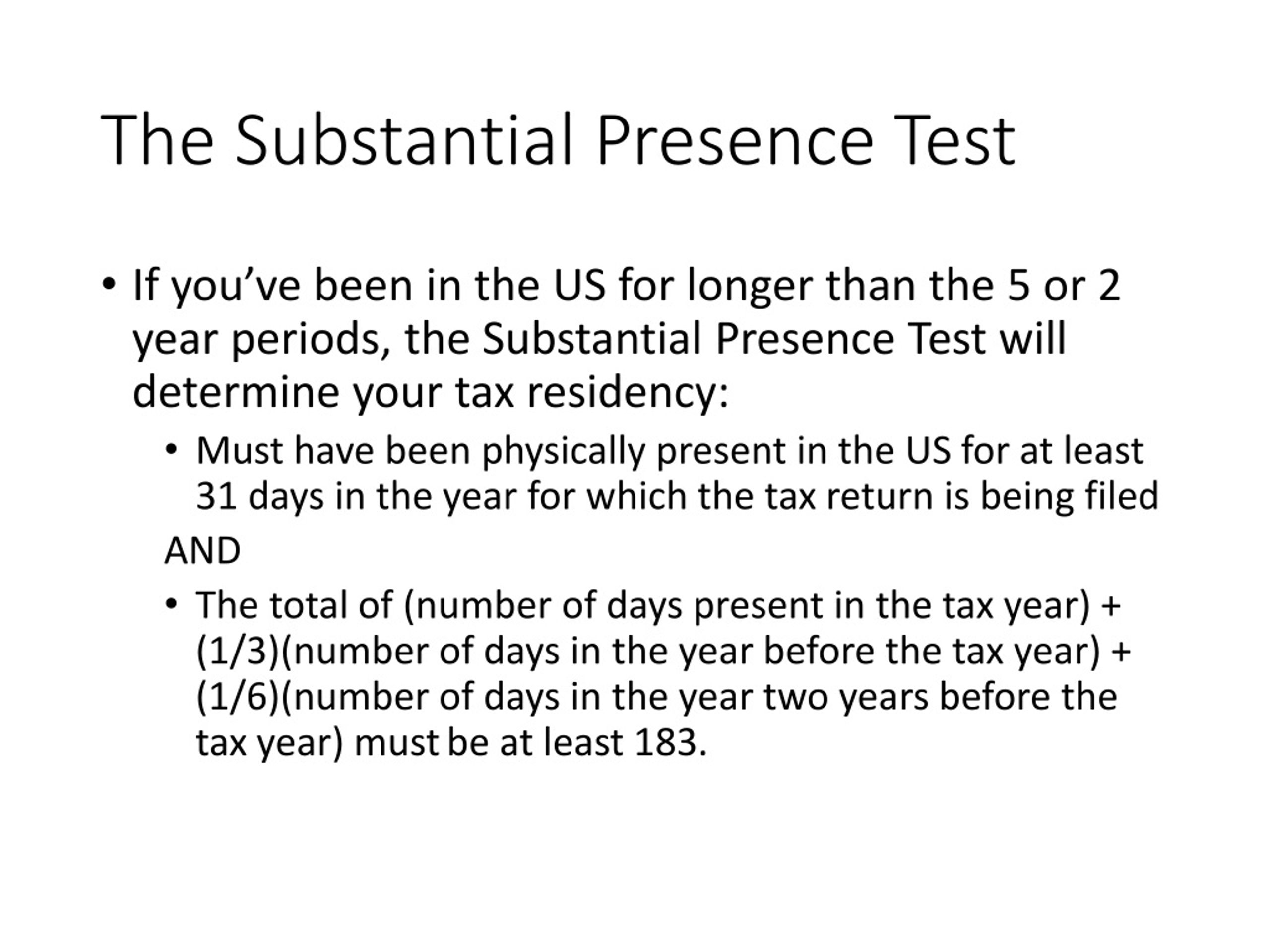

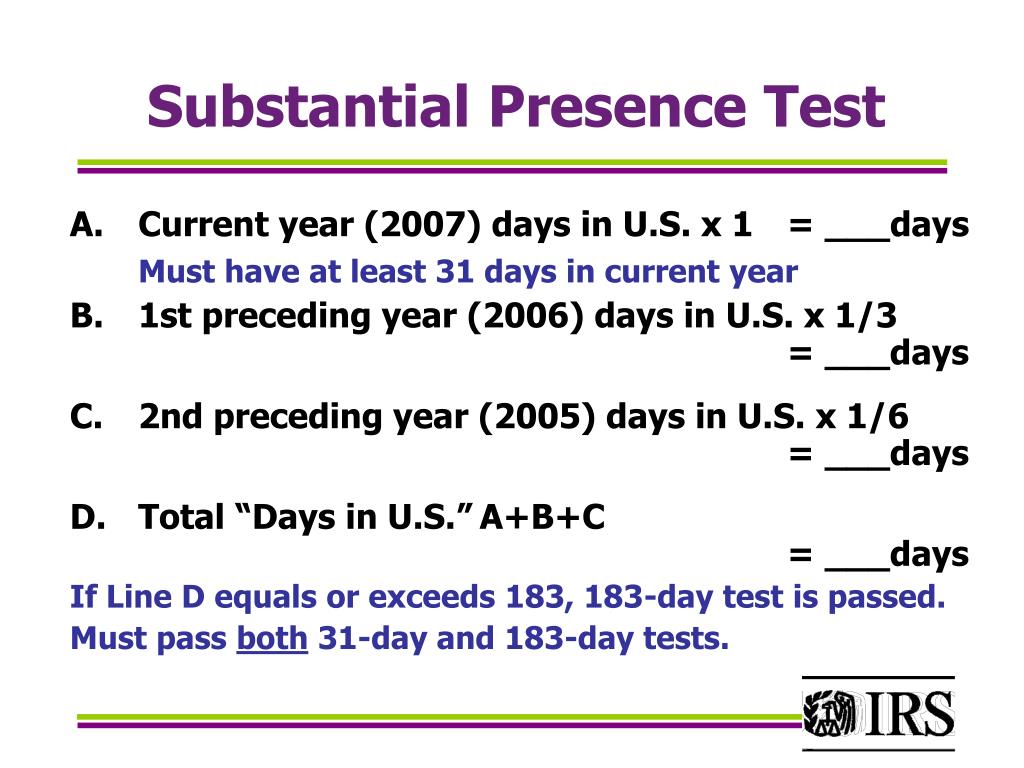

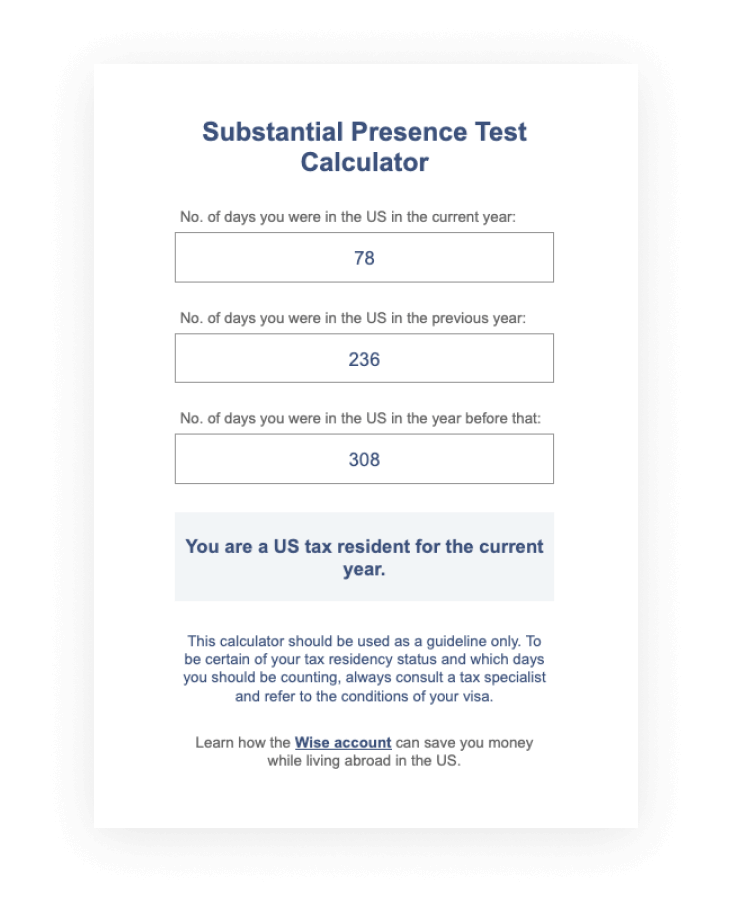

Substantial Presence Test For The Calendar Year

Substantial Presence Test For The Calendar Year - The irs will consider you a u.s. The day of the calendar year in which the. You were physically present in. Citizen, and you were physically present in the u.s. To meet the substantial presence test, you must be physically present in the united states on at least: The irs uses the substantial presence test (spt) to determine u.s. So, 2012 is the “first calendar year”, even though the foreigner was only present for 16 days during 2012. The irs substantial presence test is a criterion used to determine if an individual qualifies as a resident alien for tax purposes in the. 1/6 of the days you were present in the second year before the current year. What is the irs substantial presence test? If you are not a u.s. The substantial presence test will look at prior visits and have a. What is the irs substantial presence test? In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present on a f visa, j visa, m visa, or q visa (the number of calendar years. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count criteria and exemptions. The irs uses the substantial presence test (spt) to determine u.s. You're considered a resident alien for a calendar year if you meet the green card test or the substantial presence test for the year. So, 2012 is the “first calendar year”, even though the foreigner was only present for 16 days during 2012. Person for federal tax purposes if he or she is physically present in the united states for 183 or more days during a calendar year,. A foreign national who satisfies the substantial presence test is taxed as a resident alien. The irs will consider you a u.s. The irs uses the substantial presence test (spt) to determine u.s. The day of the calendar year in which the. You're considered a resident alien for a calendar year if you meet the green card test or the substantial presence test for the year. It provides that an alien individual is classified as. If you are not a u.s. So, 2012 is the “first calendar year”, even though the foreigner was only present for 16 days during 2012. To meet this test, you must be physically present in the united states on at least: In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present. To meet the substantial presence test, you must be physically present in the united states on at least: In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present on a f visa, j visa, m visa, or q visa (the number of calendar years. 31 days during the current tax year. 1/6 of the days you were present in the second year before the current year. 31 days during the current tax year you are asking about, and 183 days during the 3. If you are not a u.s. It provides that an alien individual is classified as a u.s. Citizen, and you were physically present in the u.s. The day of the calendar year in which the. It provides that an alien individual is classified as a u.s. The substantial presence test will look at prior visits and have a. The irs uses the substantial presence test (spt) to determine u.s. If you are not a u.s. Learn how to determine your us tax residency status with our guide to the substantial presence test. You're considered a resident alien for a calendar year if you meet the green card test or the substantial presence test for the year. In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present. The irs substantial presence test is a criterion used to determine if an individual qualifies as a resident alien for tax purposes in the. The irs uses the substantial presence test (spt) to determine u.s. To meet this test, you must be physically present in the united states on at least: You were physically present in. 1st day during the. In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present on a f visa, j visa, m visa, or q visa (the number of calendar years. So, 2012 is the “first calendar year”, even though the foreigner was only present for 16 days during 2012. 1st day during the calendar year. The irs uses the substantial presence test (spt) to determine u.s. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count criteria and exemptions. Learn how to determine your us tax residency status with our guide to the substantial presence test. The irs will consider you a u.s. The irs substantial presence test. 1/6 of the days you were present in the second year before the current year. You were physically present in. To meet the substantial presence test, you must be physically present in the united states on at least: In calculating days of presence for the substantial presence test, a person can exclude a few calendar years present on a f. The day of the calendar year in which the. You were physically present in. Learn how to accurately determine your residency status using a substantial presence test calculator, considering day count criteria and exemptions. 1st day during the calendar year on which the alien is physically present in the united states as a lawful permanent resident. So, 2012 is the “first calendar year”, even though the foreigner was only present for 16 days during 2012. A foreign national who satisfies the substantial presence test is taxed as a resident alien. You're considered a resident alien for a calendar year if you meet the green card test or the substantial presence test for the year. To meet this test, you must be physically present in the united states on at least: The irs uses the substantial presence test (spt) to determine u.s. It provides that an alien individual is classified as a u.s. The irs will consider you a u.s. 31 days during the current tax year you are asking about, and 183 days during the 3. Resident for tax purposes if you meet the substantial presence test. The substantial presence test will look at prior visits and have a. 1/6 of the days you were present in the second year before the current year. Learn how to determine your us tax residency status with our guide to the substantial presence test.Substantial Presence Test How to Calculate YouTube

Substantial Presence Test Process Diagram Substantial Presen

Unique filing status and exemption situations ppt download

PPT Tax basics for international students Informational session

PPT Internal Revenue Service Wage and Investment Stakeholder

The Substantial Presence Test How to Calculate It with Examples

Substantial Presence Test Calculator Wise

Substantial Presence Test for E2 Visa Holders Visa Franchise

Easy Substantial presence test calculator

How to use substantial presence test calculator YouTube

Person For Federal Tax Purposes If He Or She Is Physically Present In The United States For 183 Or More Days During A Calendar Year,.

If You Are Not A U.s.

To Meet The Substantial Presence Test, You Must Be Physically Present In The United States On At Least:

The Irs Substantial Presence Test Is A Criterion Used To Determine If An Individual Qualifies As A Resident Alien For Tax Purposes In The.

Related Post: