Tastytrade Calendar Call Around Earnings Work

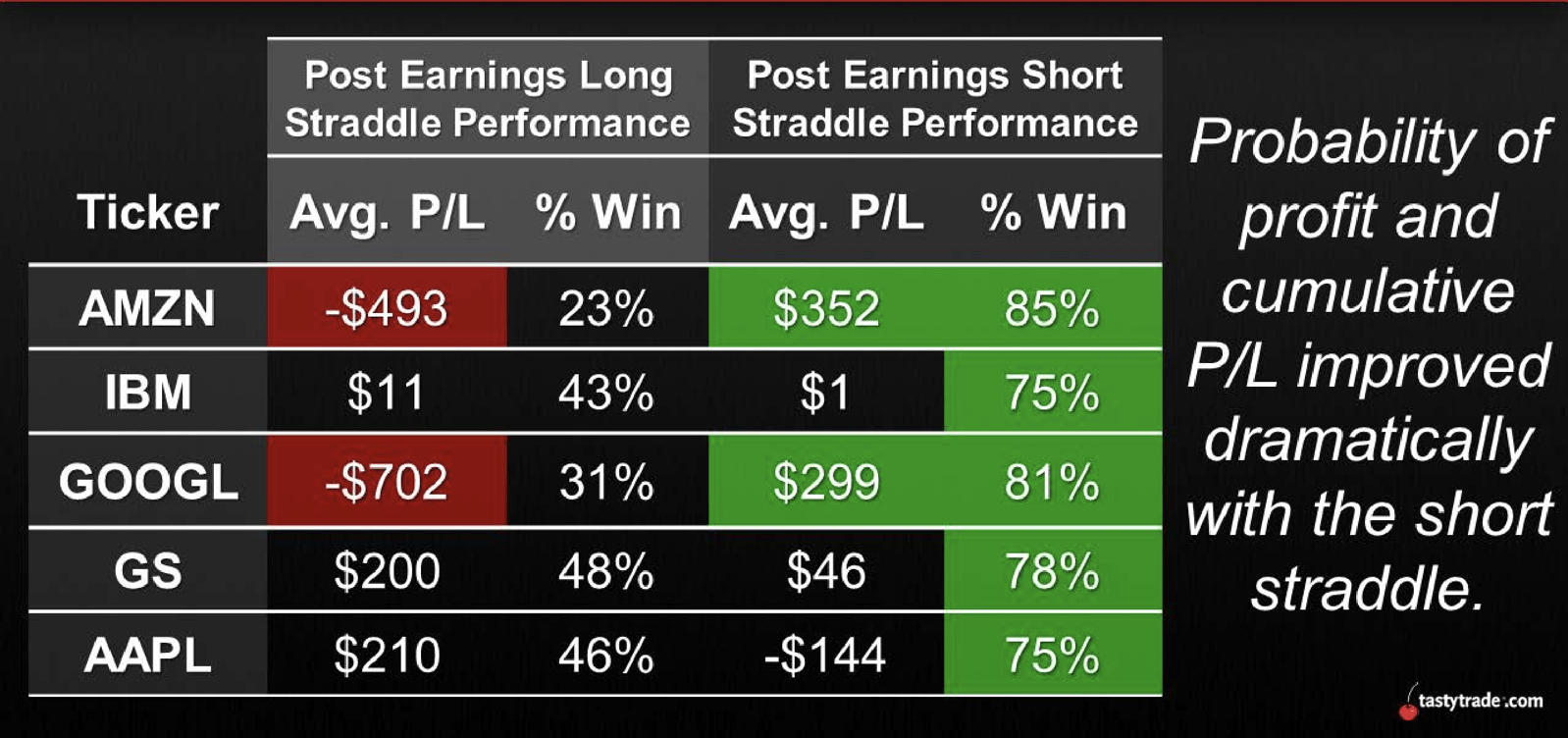

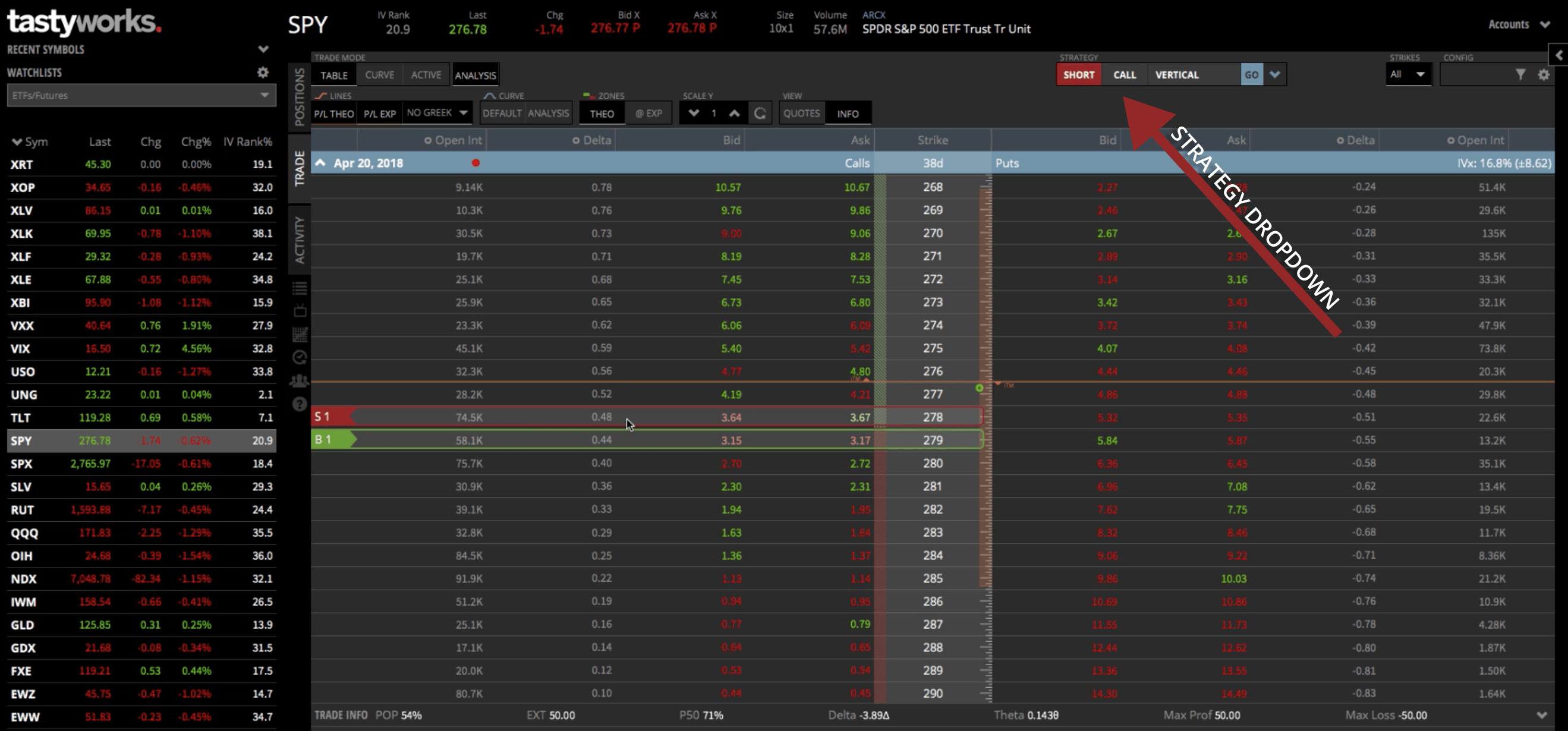

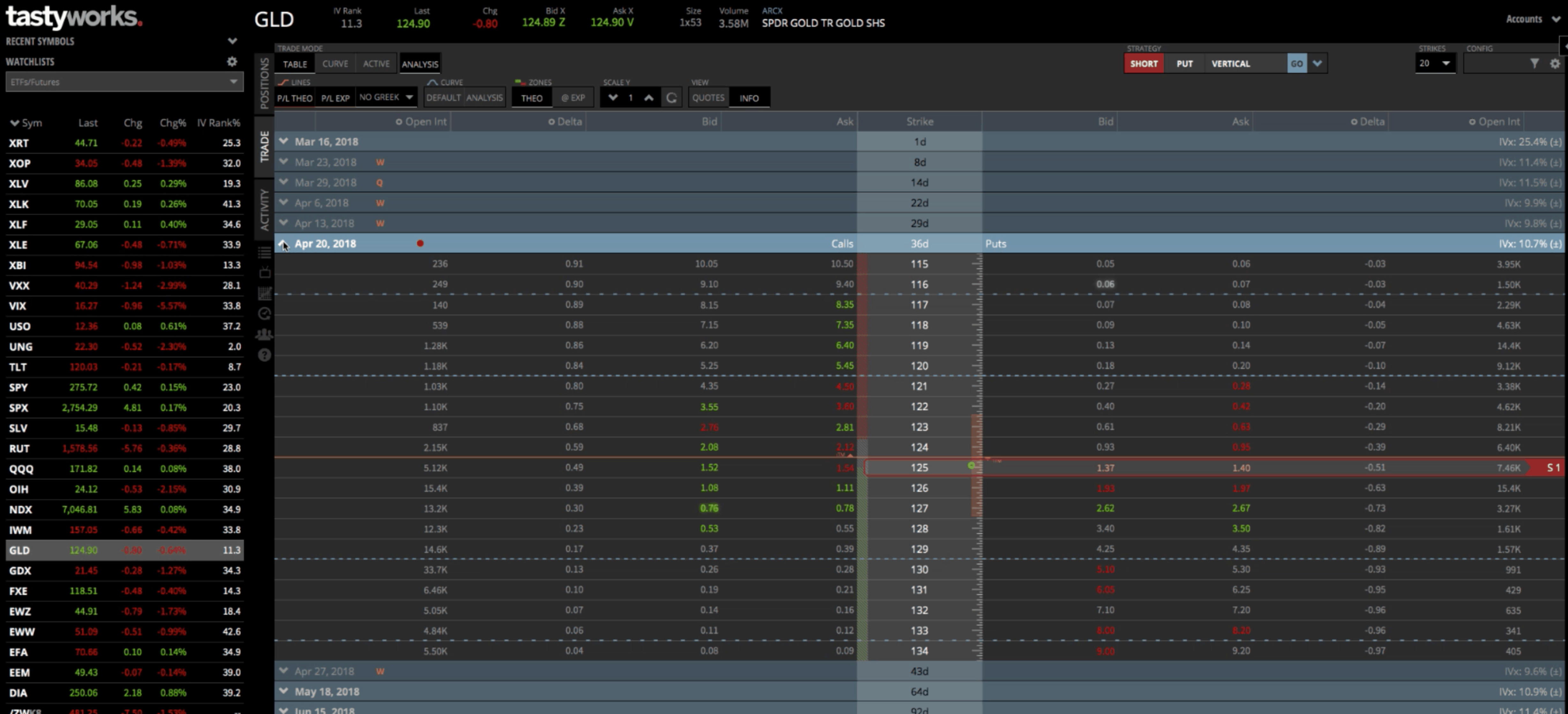

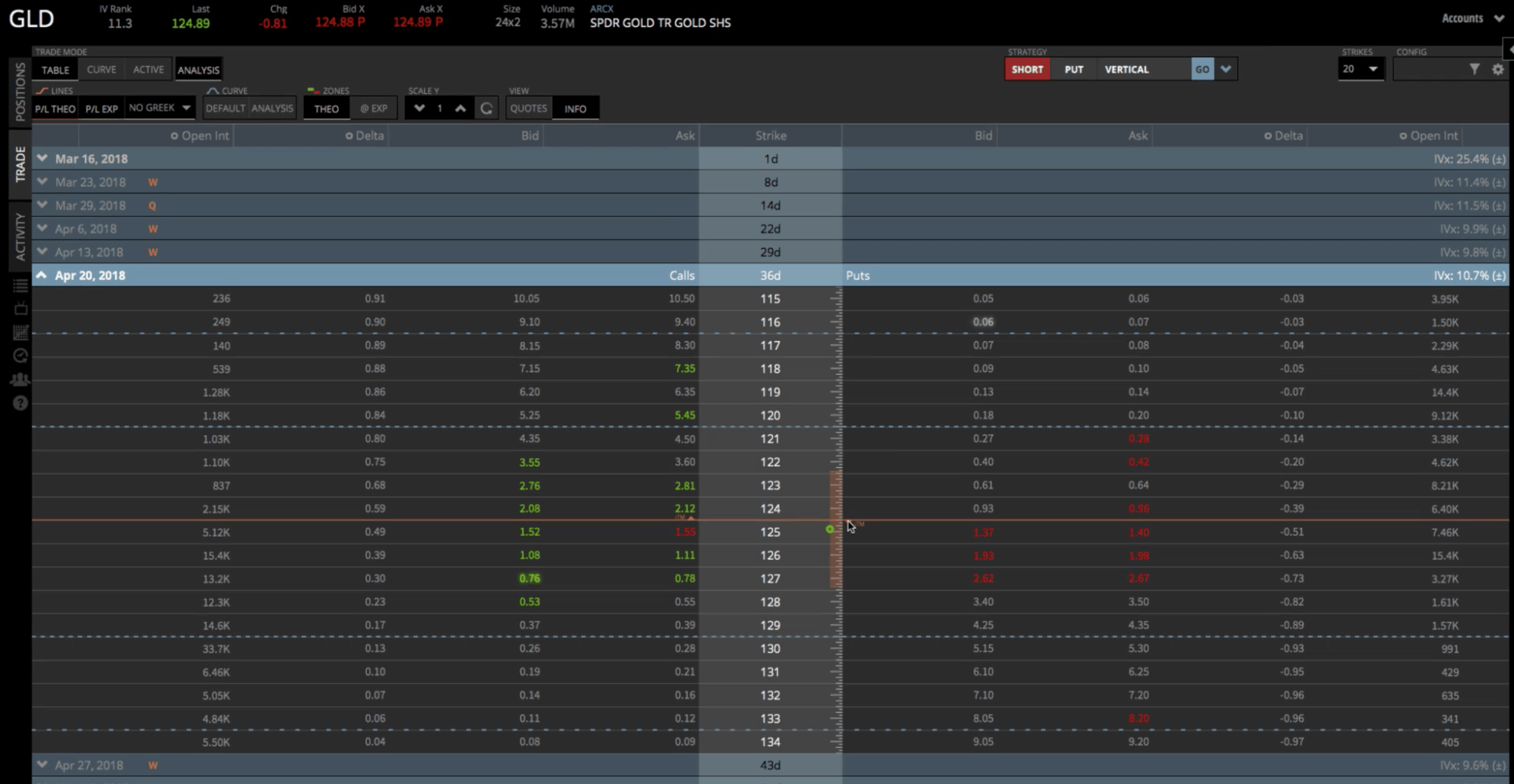

Tastytrade Calendar Call Around Earnings Work - Learn how to trade earnings with options using the best options strategies. Learn how to use calendar spreads, a call or calendar put option strategy to capitalize on earnings announcements for max gains and low risk In this video i want to show you how to trade a calendar spread on the tastytrade platform. Upon messing around with some of the sto call and bto call i got this error: Wall street expects $0.43 eps amid ai boom and new export regulations. Tasty earnings stocks listed in the tasty earnings watchlist have earnings within seven days, are listed in the s&p 500 or russell,. From the brains that brought you tastylive. Example of a long calendar spread in a margin account buy to open 4 jun 43 calls at $3.00 I signed up to tastytrade and seen they have calendar which is what i need. A pmcc position provides a covered call type of risk profile, long an itm 85 strike call in dec as the synthetic stock position, with a short 93 call in the nov monthly to offset the. Looking to trade a spread over different expirations, but don't see it listed in the strategy menu? Learn how to use calendar spreads, a call or calendar put option strategy to capitalize on earnings announcements for max gains and low risk In this video i want to show you how to trade a calendar spread on the tastytrade platform. Example of a long calendar spread in a margin account buy to open 4 jun 43 calls at $3.00 What doesn't seem to work on this portfolio is the. I signed up to tastytrade and seen they have calendar which is what i need. We can strategize around the earnings announcement with short or long options. Well, no need to panic. Wall street expects $0.43 eps amid ai boom and new export regulations. Since a calendar or diagonal. In this video i want to show you how to trade a calendar spread on the tastytrade platform. We can strategize around the earnings announcement with short or long options. When companies announce earnings, the stock price usually moves based on whether they. I signed up to tastytrade and seen they have calendar which is what i need. Learn how. When we put on calendar. We can strategize around the earnings announcement with short or long options. I signed up to tastytrade and seen they have calendar which is what i need. Looking to trade a spread over different expirations, but don't see it listed in the strategy menu? We’re looking at ticker gld, which is the gold etf. Some work better entering 7 days prior to earnings, some might improve performance with an entry as early as 21 days prior to earnings. We’re looking at ticker gld, which is the gold etf. When we put on calendar. To learn how to set up a calendar spread in the tastytrade platform, please click here. When companies announce earnings, the. Well, no need to panic. When companies announce earnings, the stock price usually moves based on whether they. Looking to trade a spread over different expirations, but don't see it listed in the strategy menu? A long put calendar spread consists of two legs: Since a calendar or diagonal. Earnings season is attractive for traders due to the increased volatility. Upon messing around with some of the sto call and bto call i got this error: Tasty earnings stocks listed in the tasty earnings watchlist have earnings within seven days, are listed in the s&p 500 or russell,. Tsmc reports earnings on jan 16, following 57.8% yoy december revenue. Wall street expects $0.43 eps amid ai boom and new export regulations. Learn how to use calendar spreads, a call or calendar put option strategy to capitalize on earnings announcements for max gains and low risk Since a calendar or diagonal. Some work better entering 7 days prior to earnings, some might improve performance with an entry as early as. Open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry. In this video i want to show you how to trade a calendar spread on the tastytrade platform. Upon messing around with some of the sto call and bto call i got this error: When we put on calendar.. A pmcc position provides a covered call type of risk profile, long an itm 85 strike call in dec as the synthetic stock position, with a short 93 call in the nov monthly to offset the. We’re looking at ticker gld, which is the gold etf. Some work better entering 7 days prior to earnings, some might improve performance with. We’re looking at ticker gld, which is the gold etf. Lists all stocks with earnings over the next 10 calendar days. Example of a long calendar spread in a margin account buy to open 4 jun 43 calls at $3.00 Some work better entering 7 days prior to earnings, some might improve performance with an entry as early as 21. Looking to trade a spread over different expirations, but don't see it listed in the strategy menu? Lists all stocks with earnings over the next 10 calendar days. Wall street expects $0.43 eps amid ai boom and new export regulations. A pmcc position provides a covered call type of risk profile, long an itm 85 strike call in dec as. Well, no need to panic. We can strategize around the earnings announcement with short or long options. Learn how to use calendar spreads, a call or calendar put option strategy to capitalize on earnings announcements for max gains and low risk Upon messing around with some of the sto call and bto call i got this error: Lists all stocks with earnings over the next 10 calendar days. From the brains that brought you tastylive. Since a calendar or diagonal. Tsmc reports earnings on jan 16, following 57.8% yoy december revenue growth. Some work better entering 7 days prior to earnings, some might improve performance with an entry as early as 21 days prior to. In this video i want to show you how to trade a calendar spread on the tastytrade platform. What doesn't seem to work on this portfolio is the. Example of a long calendar spread in a margin account buy to open 4 jun 43 calls at $3.00 A long put calendar spread consists of two legs: Wall street expects $0.43 eps amid ai boom and new export regulations. Some work better entering 7 days prior to earnings, some might improve performance with an entry as early as 21 days prior to earnings. Open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry.Earnings Season and the Calendar Spread luckbox magazine

Setting up a calendar or diagonal on tastytrade tastytrade

How To Trade A Short Call Vertical In tastytrade Navigation Trading

Setting up a calendar or diagonal on tastytrade tastytrade

tastytrade Review 2024 Pros & Cons

How to Place Calendar and Ratio Spreads on the tastytrade iPad® App

tastytrade Desktop Release Notes tastytrade

Rolling Covered Calls on Tastytrade and Calculating Annualized Return

How To Trade A Calendar Spread In tastytrade Navigation Trading

How To Trade A Calendar Spread In tastytrade Navigation Trading

Looking To Trade A Spread Over Different Expirations, But Don't See It Listed In The Strategy Menu?

When Companies Announce Earnings, The Stock Price Usually Moves Based On Whether They.

Learn How To Trade Earnings With Options Using The Best Options Strategies.

Earnings Season Is Attractive For Traders Due To The Increased Volatility.

Related Post: