Tax Calendar For Individuals

Tax Calendar For Individuals - But you're not forgotten, business filers. Employers and persons who pay excise taxes should also use the employer's tax calendar and the excise tax calendar, later. Access the calendar online from your mobile device or desktop. Direct file available starting jan. Here’s a simple breakdown of the essential dates you need to mark on your calendar to stay ahead of tax season. According to the irs refunds will generally be paid within 21 days. Stay up to date on the irs tax calendar and key filing dates. For example, january 15 marks the due. Here are some options to file your 2024 taxes for free. The irs tax calendar 2025 highlights key dates for individuals, businesses, and corporations, including estimated tax payments and filing deadlines. Make a payment of your 2025 estimated tax if you're not paying your income tax for the year through withholding (or won't pay in enough tax that way). Direct file available starting jan. Here’s a simple breakdown of the essential dates you need to mark on your calendar to stay ahead of tax season. Important tax dates for individuals. Individual tax returns due for tax year 2024 the due date for filing tax returns and making tax payments is april 15th. But you're not forgotten, business filers. 27 for taxpayers in 25 states. Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due dates for individuals,. According to the irs refunds will generally be paid within 21 days. Washington — the internal revenue service today. Direct file available starting jan. Make a payment of your 2025 estimated tax if you're not paying your income tax for the year through withholding (or won't pay in enough tax that way). This includes accepting, processing and disbursing approved refund payments via direct deposit or check. Individual tax returns due for tax year 2024 the due date for filing. Here’s a simple breakdown of the essential dates you need to mark on your calendar to stay ahead of tax season. Here are some options to file your 2024 taxes for free. Important tax dates for individuals. For a chart of information returns and due dates. But you're not forgotten, business filers. The irs tax calendar 2025 highlights key dates for individuals, businesses, and corporations, including estimated tax payments and filing deadlines. For a chart of information returns and due dates. Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due dates for individuals,. But you're not forgotten, business filers. Important tax dates for. Employers and persons who pay excise taxes should also use the employer's tax calendar and the excise tax calendar, later. Washington — the internal revenue service today. Individual tax returns due for tax year 2024 the due date for filing tax returns and making tax payments is april 15th. You can find more on business tax deadlines in the irs'. For example, january 15 marks the due. 27 for taxpayers in 25 states. Access the calendar online from your mobile device or desktop. Use the irs tax calendar to view filing deadlines and actions each month. But you're not forgotten, business filers. This tax calendar has the due dates for 2025 that most taxpayers will need. Make a payment of your 2025 estimated tax if you're not paying your income tax for the year through withholding (or won't pay in enough tax that way). Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due. Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due dates for individuals,. For example, january 15 marks the due. Here’s a simple breakdown of the essential dates you need to mark on your calendar to stay ahead of tax season. Stay up to date on the irs tax calendar and key. Here’s a simple breakdown of the essential dates you need to mark on your calendar to stay ahead of tax season. Individual tax returns due for tax year 2024 the due date for filing tax returns and making tax payments is april 15th. The irs tax calendar 2025 highlights key dates for individuals, businesses, and corporations, including estimated tax payments. Stay up to date on the irs tax calendar and key filing dates. Direct file available starting jan. Use the irs tax calendar to view filing deadlines and actions each month. Employers and persons who pay excise taxes should also use the employer's tax calendar and the excise tax calendar, later. This includes accepting, processing and disbursing approved refund payments. For a chart of information returns and due dates. But you're not forgotten, business filers. Use the irs tax calendar to view filing deadlines and actions each month. Important tax dates for individuals. Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due dates for individuals,. Stay up to date on the irs tax calendar and key filing dates. For example, january 15 marks the due. 27 for taxpayers in 25 states. Access the calendar online from your mobile device or desktop. Important tax dates for individuals. This includes accepting, processing and disbursing approved refund payments via direct deposit or check. Here are some options to file your 2024 taxes for free. This tax calendar has the due dates for 2025 that most taxpayers will need. According to the irs refunds will generally be paid within 21 days. Individual tax returns due for tax year 2024 the due date for filing tax returns and making tax payments is april 15th. The irs tax calendar 2025 highlights key dates for individuals, businesses, and corporations, including estimated tax payments and filing deadlines. Our 2025 tax calendar gives you a quick reference to the most common forms and 2025 tax due dates for individuals,. Free file program now open; Most of the key tax dates below are for individual taxpayers. You can find more on business tax deadlines in the irs' online tax. But you're not forgotten, business filers.IRS Tax Calendar for Businesses and SelfEmployed Irs taxes, Irs, Tax

Comprehensive Tax Compliance Calendar for FY 202223 Covering Important

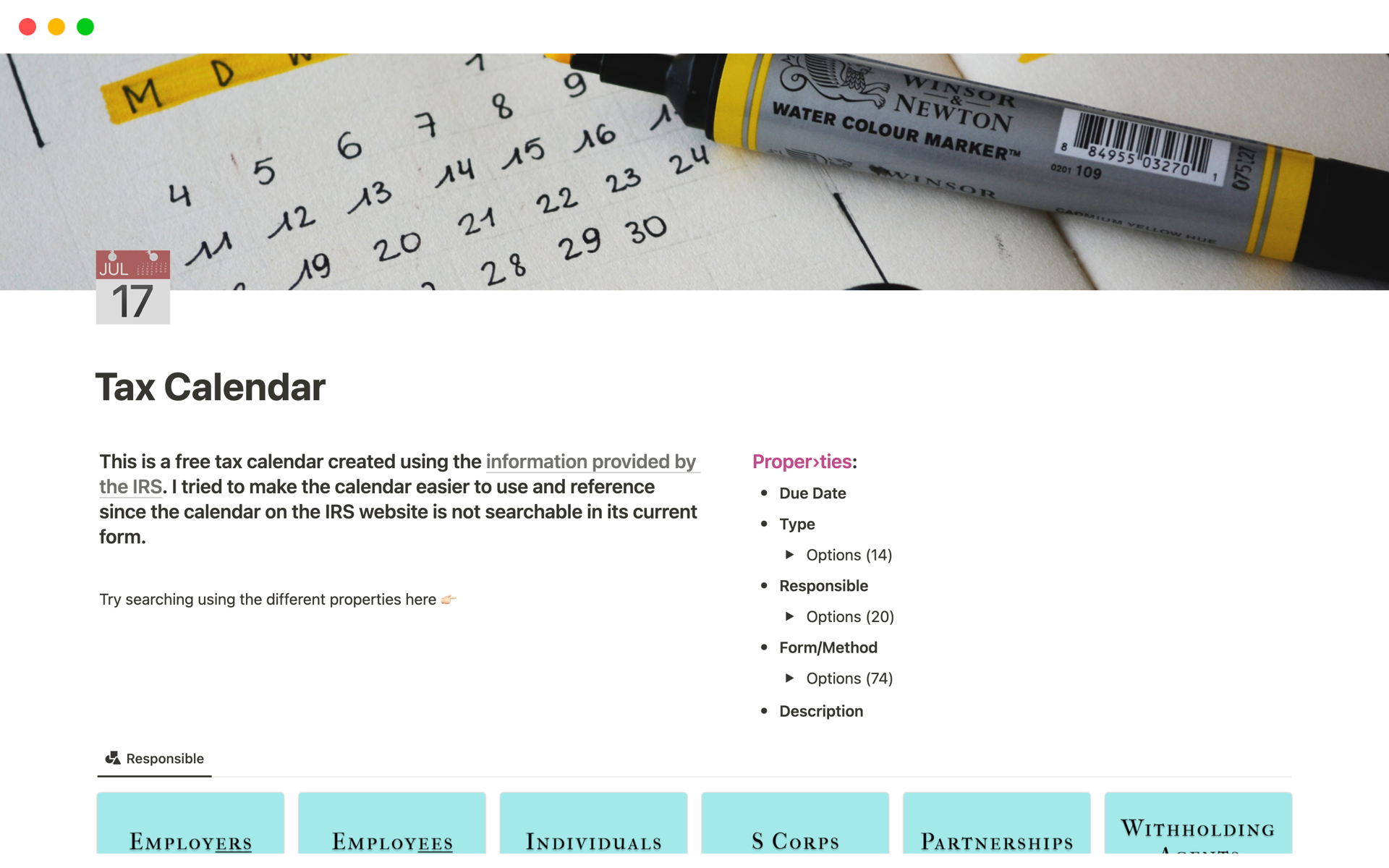

Tax Calendar Notion Template

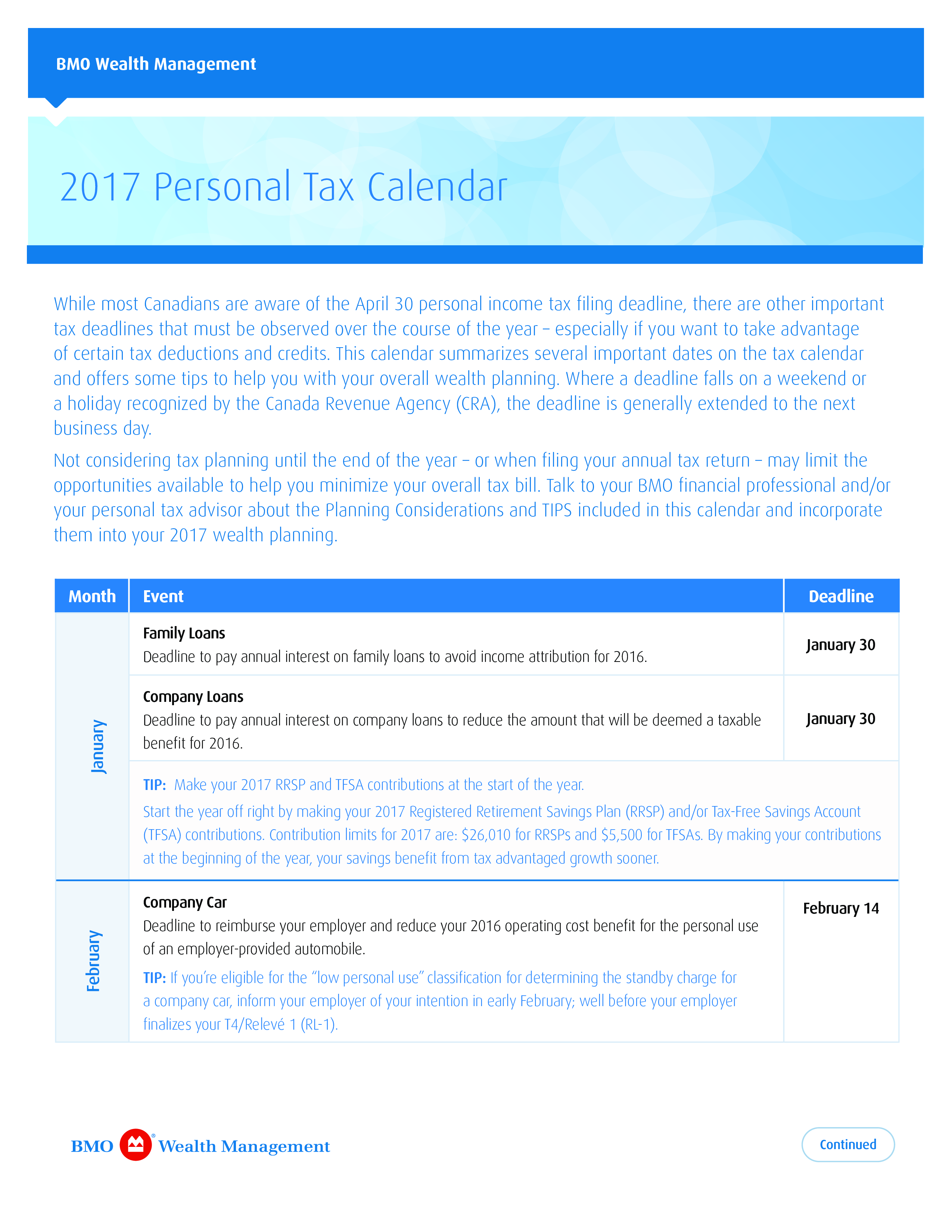

Personal Tax Calendar Adel Nataline

Tax Calendar 2023 Full list of due dates and activities to be

Calendars — PacificoTax

2023 Tax Calendar for Individuals YHB CPAs & Consultants

2021 Tax Calendar for Individuals and Businesses SVA CPA

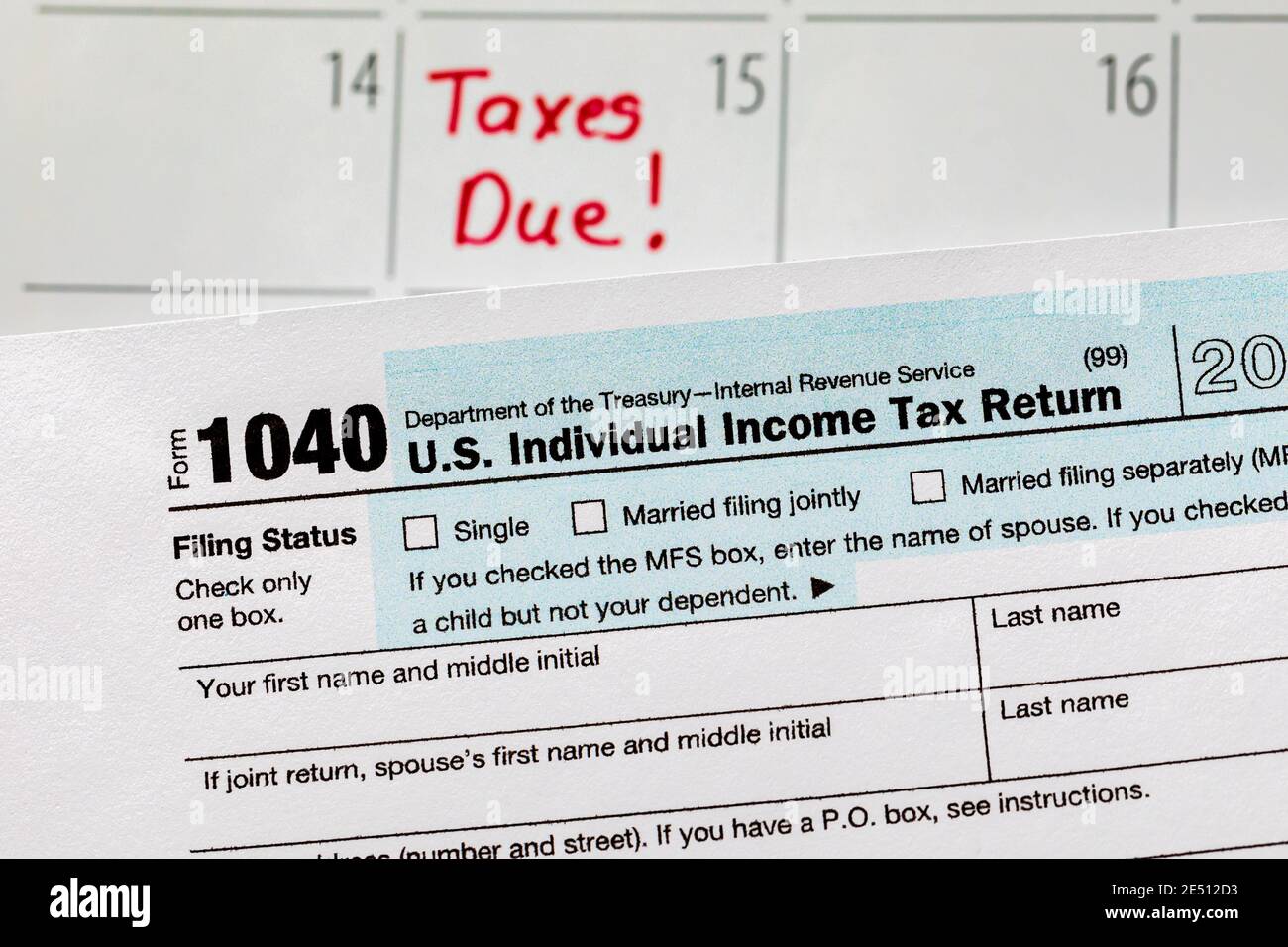

1040 individual tax return form and calendar with filing

2024 Tax Calendar for Individuals YHB CPAs & Consultants

Make A Payment Of Your 2025 Estimated Tax If You're Not Paying Your Income Tax For The Year Through Withholding (Or Won't Pay In Enough Tax That Way).

Employers And Persons Who Pay Excise Taxes Should Also Use The Employer's Tax Calendar And The Excise Tax Calendar, Later.

The 2025 Tax Season Will Begin On Jan.

Use The Irs Tax Calendar To View Filing Deadlines And Actions Each Month.

Related Post: