Tax Year Calendar

Tax Year Calendar - Due date for first installment of 2025 estimated tax payments; Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. You must figure your taxable income on the basis of a tax year. A section on how to. There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. In the u.s., the tax year for individuals runs from jan. All taxpayers should be aware of the new income tax brackets, deduction amounts and exemption amounts. This publication contains the following. One great way to maximize tax savings and minimize any tax fees or penalties is to become familiar with important dates and milestones that trigger tax implications. The tax years you can use are: There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. Due date for first installment of 2025 estimated tax payments; All taxpayers should be aware of the new income tax brackets, deduction amounts and exemption amounts. What does this publication contain? Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. This publication contains the following. If you file your tax returns during this time, your tax refund may be delayed due. One great way to maximize tax savings and minimize any tax fees or penalties is to become familiar with important dates and milestones that trigger tax implications. In the u.s., the tax year for individuals runs from jan. Bookmark this website to track key 2025. An annual accounting period does not include a short tax year. For more information, see the instructions for form 2290. The calendar gives specific due dates for: A section on how to. Due date for first installment of 2025 estimated tax payments; There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. Bookmark this website to track key 2025. The calendar gives specific due dates for: You must pay the full year's tax on all vehicles you have in use during the month of july. The tax years you can use are: If you file your tax returns during this time, your tax refund may be delayed due. A tax year is an annual accounting period for keeping records and reporting income and expenses. You must pay the full year's tax on all vehicles you have in use during the month of july. A section on how to. There is a long. Due date for first installment of 2025 estimated tax payments; This publication contains the following. What does this publication contain? There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. You must figure your taxable income on the basis of a tax year. The tax period begins on july 1 and ends the following june 30. What does this publication contain? You must pay the full year's tax on all vehicles you have in use during the month of july. Due date for first installment of 2025 estimated tax payments; This publication contains the following. There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. 31 and includes taxes owed on earnings during that. Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. You must figure your taxable income on the basis of a tax year. You must. The tax years you can use are: An annual accounting period does not include a short tax year. Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. All taxpayers should be aware of the new income tax brackets, deduction amounts and exemption amounts. Bookmark this website to track key 2025. There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. What does this publication contain? Due date for first installment of 2025 estimated tax payments; 31 and includes taxes owed on earnings during that. The irs expects to receive around 140 million tax returns in 2025. You must figure your taxable income on the basis of a tax year. Estimate your potential income taxes using our income tax calculator before filing. An annual accounting period does not include a short tax year. In the u.s., the tax year for individuals runs from jan. One great way to maximize tax savings and minimize any tax fees or. Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. A tax year is an annual accounting period for keeping records and reporting income and expenses. In the u.s., the tax year for individuals runs from jan. If you file your tax returns during this time, your tax refund may be delayed due.. For more information, see the instructions for form 2290. Estimate your potential income taxes using our income tax calculator before filing. In the u.s., the tax year for individuals runs from jan. Deadline for filing a 2024 personal return for us citizens or residents living and working abroad, including. An annual accounting period does not include a short tax year. The tax years you can use are: Bookmark this website to track key 2025. You must pay the full year's tax on all vehicles you have in use during the month of july. What does this publication contain? There is a long list of specific dates that have tax significance for some, and often times all, taxpayers. The tax period begins on july 1 and ends the following june 30. If you file your tax returns during this time, your tax refund may be delayed due. Deadline to claim a 2021 tax year refund; 31 and includes taxes owed on earnings during that. One great way to maximize tax savings and minimize any tax fees or penalties is to become familiar with important dates and milestones that trigger tax implications. You must figure your taxable income on the basis of a tax year.Tax Year Calendar 2019 2020

Fiscal 2024 Calendar Printable Calendars AT A GLANCE

FREE 8+ Sample Fiscal Calendar Templates in Excel PDF

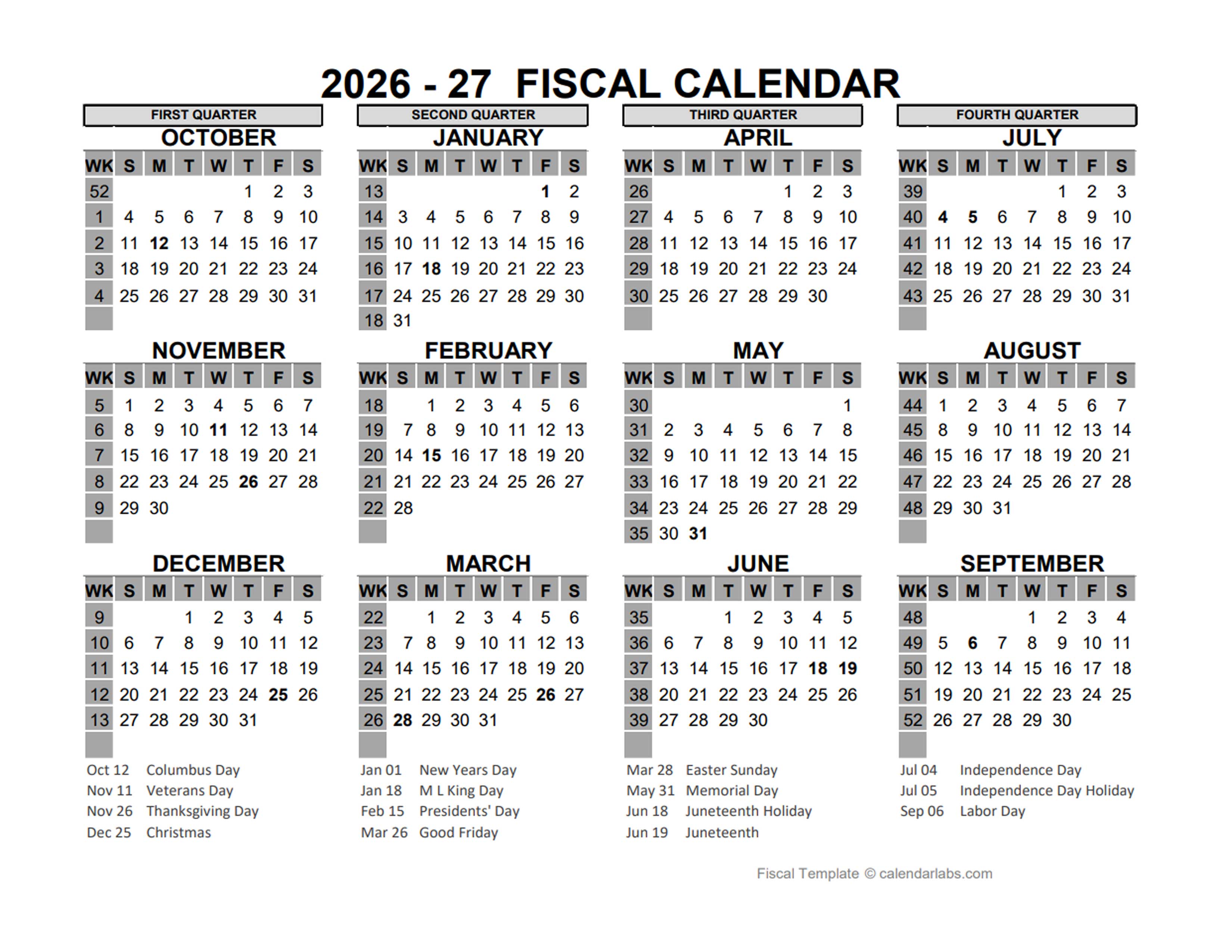

2026 US Fiscal Year Template Free Printable Templates

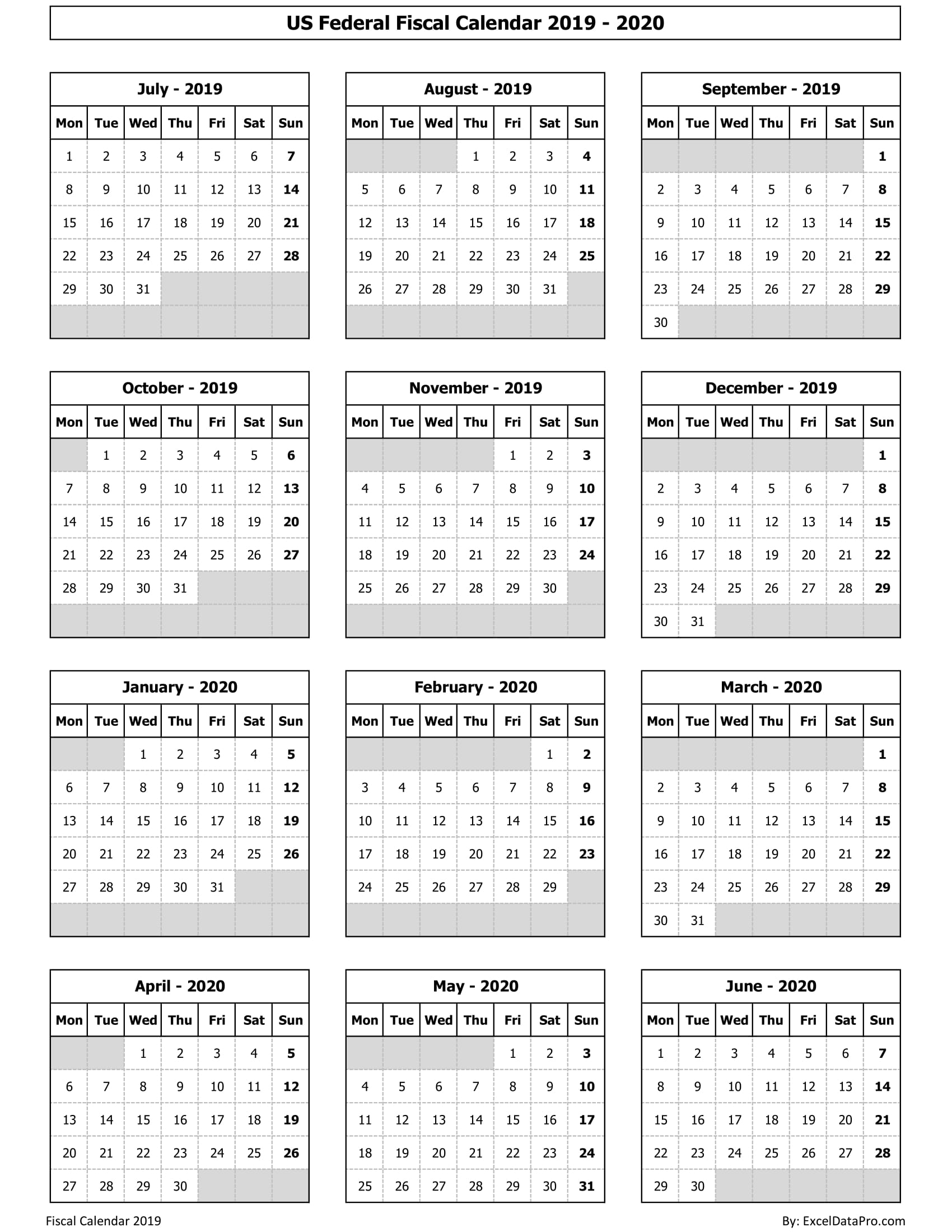

Download US Federal Fiscal Calendar 201920 Excel Template ExcelDataPro

Download Printable Fiscal Year Calendar Template PDF

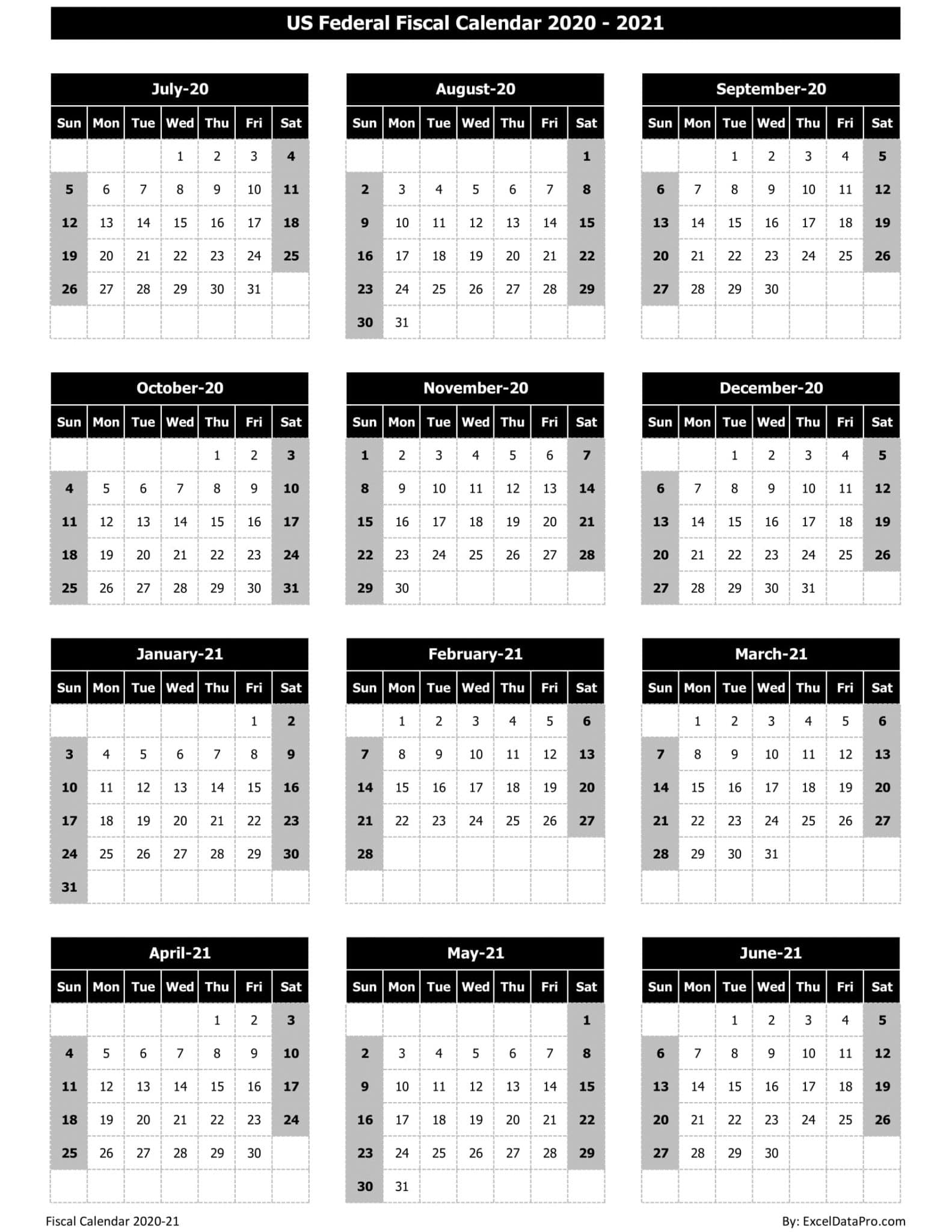

Download US Federal Fiscal Calendar 202021 Excel Template ExcelDataPro

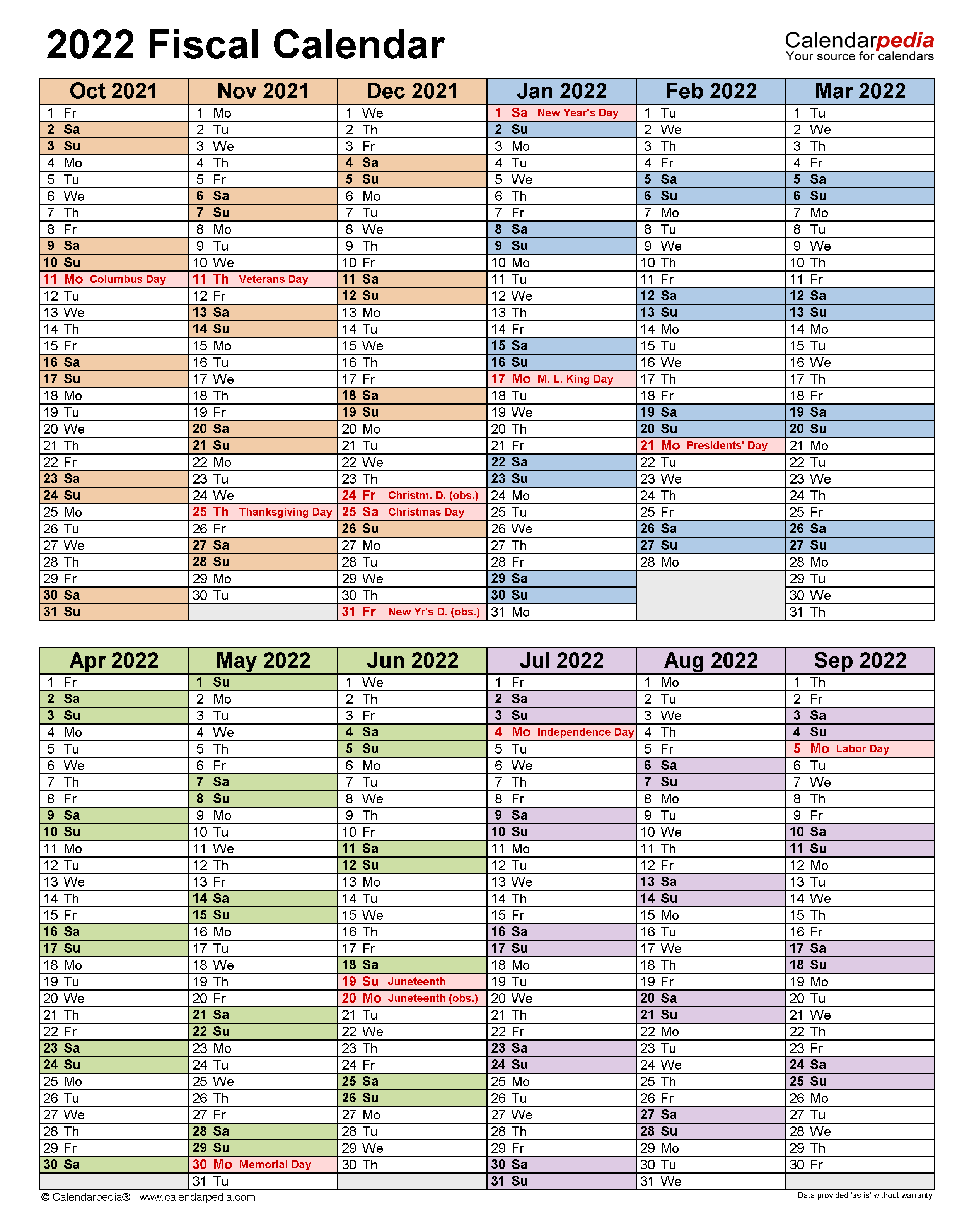

2022 2022 Fiscal Year Calendar

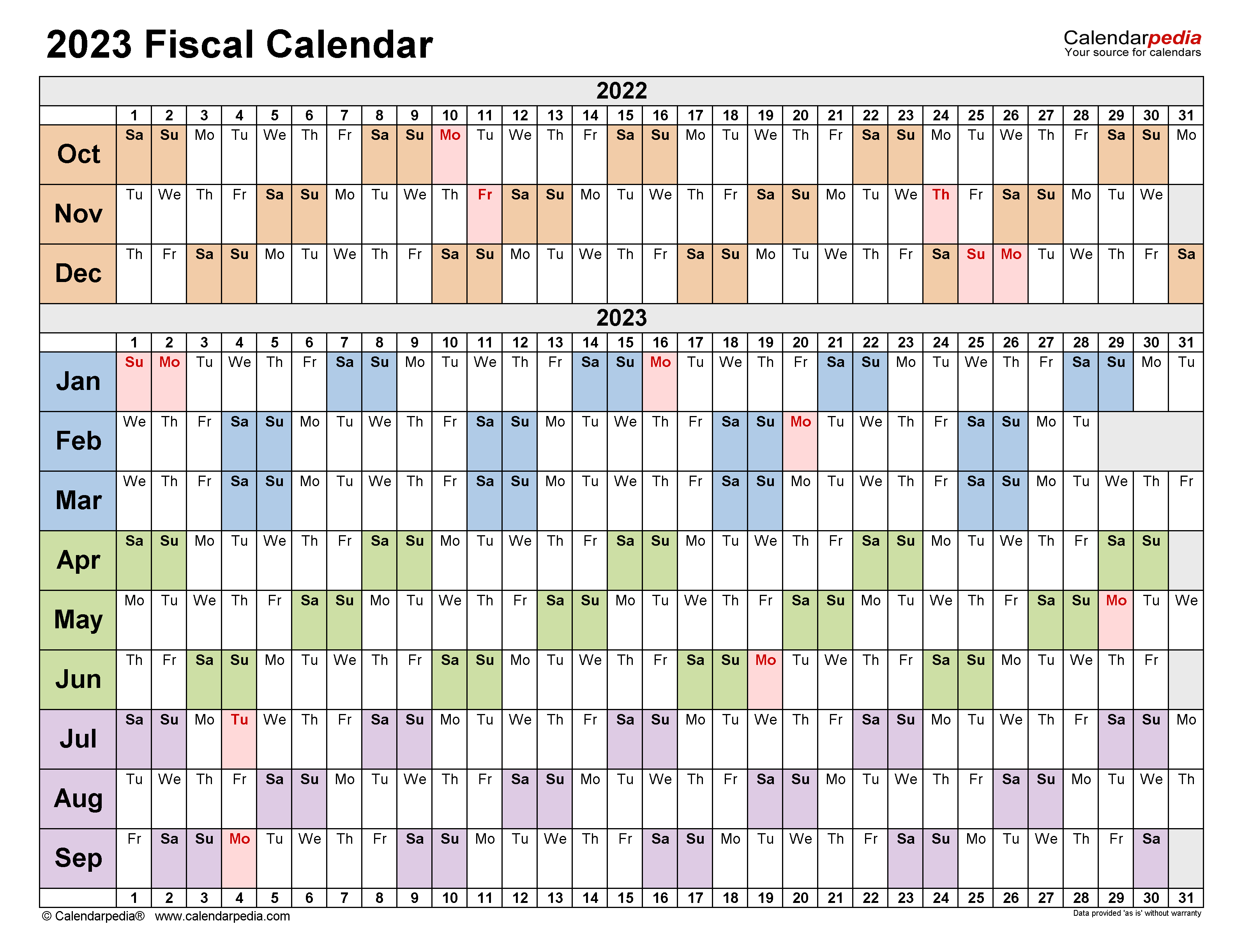

Fiscal Calendars 2023 Free Printable Excel templates

Download US Federal Fiscal Calendar 202021 Excel Template ExcelDataPro

A Tax Year Is An Annual Accounting Period For Keeping Records And Reporting Income And Expenses.

All Taxpayers Should Be Aware Of The New Income Tax Brackets, Deduction Amounts And Exemption Amounts.

A Section On How To.

The Calendar Gives Specific Due Dates For:

Related Post: