Tax Year Vs Calendar Year

Tax Year Vs Calendar Year - Aligning the tax year with the calendar year makes tax filing easier for individuals and businesses. A fiscal year lumps everything—income and expenses—into one tidy tax. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive months that. It’s intuitive and aligns with most owners’ personal returns, making it about as simple as anything involving. This effectively ties the trust’s tax year to the grantor’s personal tax year, typically the calendar year. Are not in existence for an entire tax year, or 2. Many business owners use a calendar year as their company’s tax year. It’s intuitive and aligns with most owners’ personal returns,. It replaces assessment year and previous year with tax year and financial year. this shift aims. Many business owners use a calendar year as their company’s tax year. Many business owners use a calendar year as their company’s tax year. It’s intuitive and aligns with most owners’ personal returns, making it about as simple as anything involving. Since most people are already familiar with the calendar year, it provides a. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive months that. Find out the advantages, disadvantages, and. A short tax year is a tax year of less than 12 months. A business's tax year is 12 months used for financial accounting, budgeting, and reporting. A fiscal year lumps everything—income and expenses—into one tidy tax. What is the ‘tax year’ concept? The proposed income tax bill 2025 introduces a key terminology change. Learn the difference between a calendar tax year and a fiscal tax year, and how to choose the best option for your business. While many businesses choose this. Your business's tax return deadline typically. A short period tax return may be required when you (as a taxable entity): The irs expects more than 140 million individual tax returns for tax. While many businesses choose this. Picking a fiscal year instead of a calendar year shakes up how you report what you earn and spend. A fiscal year lumps everything—income and expenses—into one tidy tax. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. This effectively ties the trust’s. For instance, if a grantor trust generates income, that income is reported on the. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive months that. A short tax year is a tax year of less than 12 months. The irs expects more. While many businesses choose this. Learn the difference between a calendar tax year and a fiscal tax year, and how to choose the best option for your business. Understanding what each involves can help you. In this article, we discuss the difference between the two tax years, special considerations for nonprofits, and how to change your selection. Find out the. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Your business's tax return deadline typically. The assessment year is used by the income tax department to calculate and determine the tax liability of individuals, businesses, and other entities based on the income. What is the difference between a. Since most people are already familiar with the calendar year, it provides a. The assessment year is used by the income tax department to calculate and determine the tax liability of individuals, businesses, and other entities based on the income. A company must use a calendar year. For instance, if a grantor trust generates income, that income is reported on. A company must use a calendar year. Understanding what each involves can help you. The irs expects more than 140 million individual tax returns for tax year 2024 to be filed ahead of the tuesday, april 15 federal deadline. A short tax year is a tax year of less than 12 months. Choosing between a calendar year and a fiscal. Since most people are already familiar with the calendar year, it provides a. A company must use a calendar year. Aligning the tax year with the calendar year makes tax filing easier for individuals and businesses. More than half of all tax returns are. A fiscal year lumps everything—income and expenses—into one tidy tax. The proposed income tax bill 2025 introduces a key terminology change. What is the difference between a fiscal year and a calendar year? While many businesses choose this. What is the ‘tax year’ concept? Many business owners use a calendar year as their company’s tax year. The assessment year is used by the income tax department to calculate and determine the tax liability of individuals, businesses, and other entities based on the income. It’s intuitive and aligns with most owners’ personal returns,. Although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for. While many businesses choose this. Aligning the tax year with the calendar year makes tax filing easier for individuals and businesses. Many business owners use a calendar year as their company’s tax year. Based on irs guidelines, business owners have two income reporting methods they can use which will dictate how their. A fiscal year lumps everything—income and expenses—into one tidy tax. The assessment year is used by the income tax department to calculate and determine the tax liability of individuals, businesses, and other entities based on the income. The tax year can end at different times depending on how a business files taxes. It replaces assessment year and previous year with tax year and financial year. this shift aims. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Find out the advantages, disadvantages, and. It’s intuitive and aligns with most owners’ personal returns,. The irs expects more than 140 million individual tax returns for tax year 2024 to be filed ahead of the tuesday, april 15 federal deadline. A company must use a calendar year. What is the ‘tax year’ concept? Choosing between a calendar year and a fiscal year. It’s intuitive and aligns with most owners’ personal returns, making it about as simple as anything involving.Fiscal Year vs. Calendar Year Key Differences by Blogwaly Oct

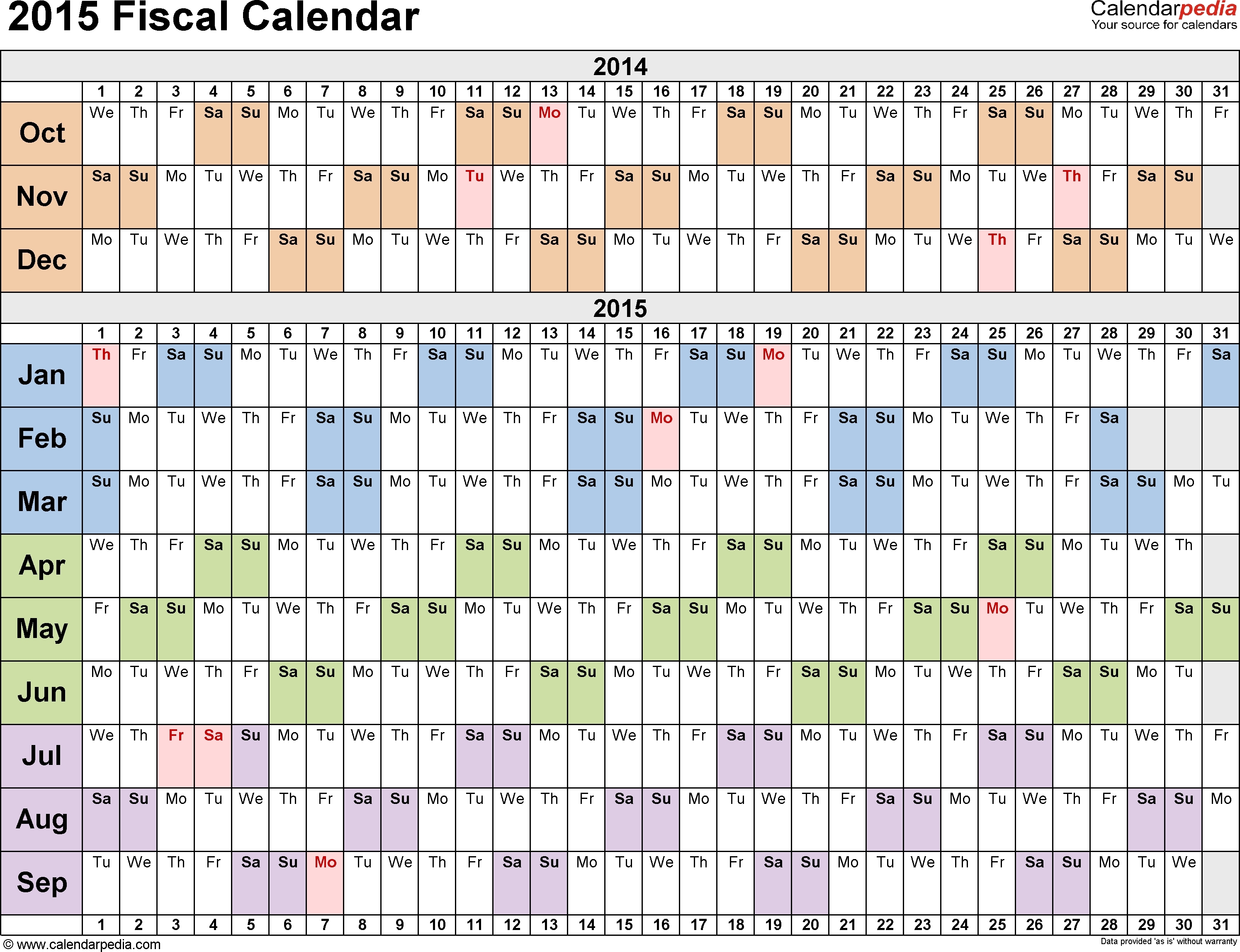

Fiscal Year Vs Calendar Year Template Calendar Design

Fiscal Year Vs Calendar Year Tax Abbye Annissa

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year What is the Difference?

Fiscal Year vs Calendar Year What's The Difference?

Calendar Year Vs Tax Year 2024 Calendar 2024 Ireland Printable

Fiscal Year Vs Calendar Year What's Best for Your Business?

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

What is a Fiscal Year? Your GoTo Guide

Learn The Difference Between A Calendar Tax Year And A Fiscal Tax Year, And How To Choose The Best Option For Your Business.

More Than Half Of All Tax Returns Are.

Many Business Owners Use A Calendar Year As Their Company’s Tax Year.

The Irs Defines A Tax Year As.

Related Post: