Texas Sales Tax Calendar

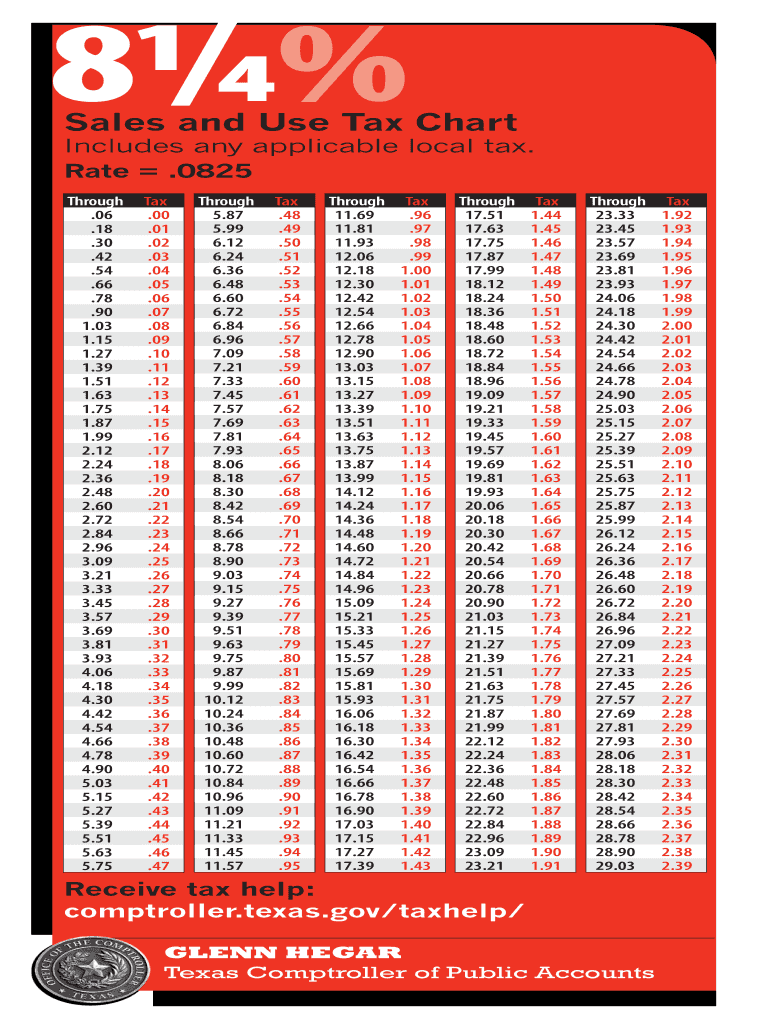

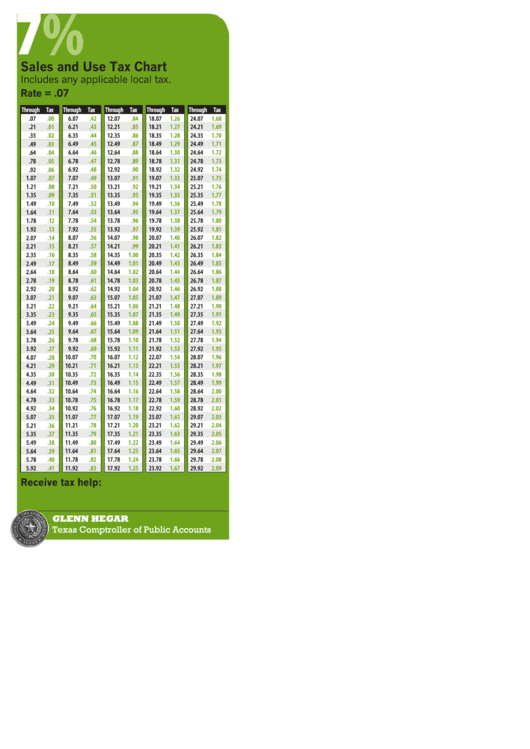

Texas Sales Tax Calendar - Local taxing jurisdictions (cities, counties, special. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. 2025 reporting due dates for taxes, fees and reports. On this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. A sales tax holiday is a temporary break from sales tax — a time when consumers don’t pay sales tax on certain goods and/or services that are normally taxable. We know timing and planning are critical for retailers, so we encourage you to mark your. Welcome to the new sales tax rate locator. This chart can be used to easily calculate texas sales taxes. Texas comptroller sales tax holiday. Washington — the internal revenue service today. Texas sales tax varies by location. There is a statewide sales tax of 6.25%. Local taxing jurisdictions (cities, counties, special. Index for sales tax frequently asked questions. Comptroller glenn hegar distributes $1.5 billion in monthly sales tax revenue to local governments (austin) — texas comptroller glenn hegar. There are a number of ways to pay: Employer identification number (ein) is also known as a federal tax identification number, and is used. Texas sales tax holiday calendar. This is a printable texas sales tax table, by sale amount, which can be customized by sales tax rate. Easy to use state tax calendar for texas. Texas charges both a state sales tax and local sales tax. Index for sales tax frequently asked questions. Texas sales tax varies by location. We know timing and planning are critical for retailers, so we encourage you to mark your. Welcome to the new sales tax rate locator. You can also submit a payment for a period with an open liability. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Texas comptroller sales tax holiday. Taxpayer id is an eleven digit number assigned by the texas comptroller. 2025 reporting due dates for. Local taxing jurisdictions (cities, counties, special. Direct file available starting jan. A sales tax holiday is a temporary break from sales tax — a time when consumers don’t pay sales tax on certain goods and/or services that are normally taxable. During texas’s annual sales tax holidays, certain taxable items are exempt from tax for a limited time. Washington — the. In addition, local taxing jurisdictions such as counties, cities, special purpose districts, and transit authorities. Washington — the internal revenue service today. Easy to use state tax calendar for texas. We know timing and planning are critical for retailers, so we encourage you to mark your. A sales tax is a tax imposed on the sale of goods and services,. Index for sales tax frequently asked questions. Welcome to the new sales tax rate locator. The next upcoming due date for each filing schedule is marked in green. The due date for monthly filers is the 20th of. Comptroller glenn hegar distributes $1.5 billion in monthly sales tax revenue to local governments (austin) — texas comptroller glenn hegar. Easy to use state tax calendar for texas. Employer identification number (ein) is also known as a federal tax identification number, and is used. This chart can be used to easily calculate texas sales taxes. You can also submit a payment for a period with an open liability. Payments and prepayments can be submitted via the webfile system for the. Index for sales tax frequently asked questions. Easy to use state tax calendar for texas. Employer identification number (ein) is also known as a federal tax identification number, and is used. In addition, local taxing jurisdictions such as counties, cities, special purpose districts, and transit authorities. Comptroller glenn hegar distributes $1.5 billion in monthly sales tax revenue to local governments. The calendar gives specific due dates for filing tax forms, paying taxes, and taking other actions required by federal tax law. For applicable taxes, quarterly reports are due in april, july, october and january. Easy to use state tax calendar for texas. The due date for monthly filers is the 20th of. 2025 reporting due dates for taxes, fees and. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Taxpayer id is an eleven digit number assigned by the texas comptroller. Direct file available starting jan. Easy to use state tax calendar for texas. Texas charges both a state sales tax and local sales. A sales tax holiday is a temporary break from sales tax — a time when consumers don’t pay sales tax on certain goods and/or services that are normally taxable. Texas comptroller sales tax holiday. Free file program now open; Texas sales tax holiday calendar. The next upcoming due date for each filing schedule is marked in green. 2025 reporting due dates for taxes, fees and reports. The next upcoming due date for each filing schedule is marked in green. Taxpayer id is an eleven digit number assigned by the texas comptroller. This chart can be used to easily calculate texas sales taxes. Index for sales tax frequently asked questions. In addition, local taxing jurisdictions such as counties, cities, special purpose districts, and transit authorities. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. There are a number of ways to pay: What is sales tax in texas? The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date and end date of each tax. The due date for monthly filers is the 20th of. We know timing and planning are critical for retailers, so we encourage you to mark your. On this page we have compiled a calendar of all sales tax due dates for texas, broken down by filing frequency. A sales tax holiday is a temporary break from sales tax — a time when consumers don’t pay sales tax on certain goods and/or services that are normally taxable. Payments and prepayments can be submitted via the webfile system for the current report period without filing a report. Texas charges both a state sales tax and local sales tax.Texas Sales Tax Rate Tax Sales Tax Sales Chart And if you’re

Our World in Data Texas Covid Rates Chart

Texas Sales Tax Guide for Businesses

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF

Ultimate Texas Sales Tax Guide Zamp

Sales Tax Calculator 2024 Texas Danna Yoshiko

Sales Tax Rate Texas 2024 Karee Marjory

Texas Sales Tax Chart Printable

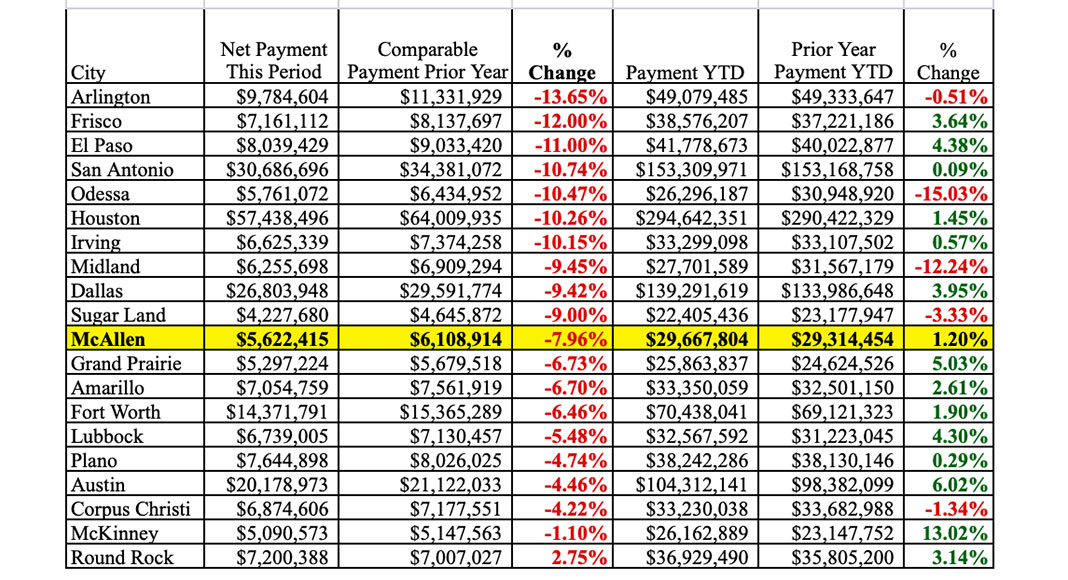

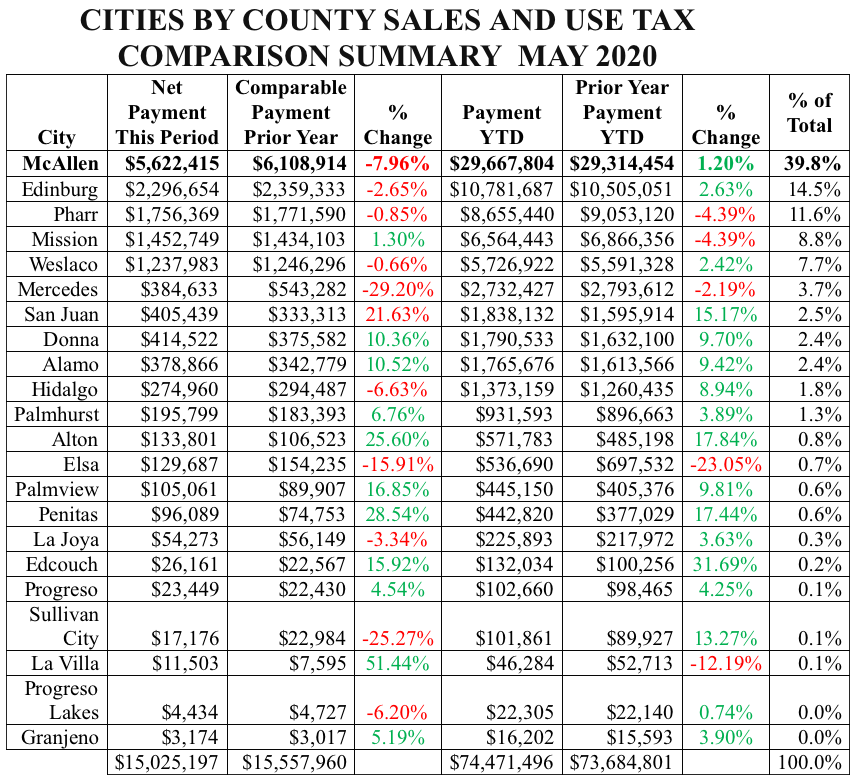

May 2020 Sales Tax Info Texas Border Business

More data concerning MAY 2020 SALES TAX INFO Texas Border Business

During Texas’s Annual Sales Tax Holidays, Certain Taxable Items Are Exempt From Tax For A Limited Time.

Texas Comptroller Sales Tax Holiday.

Texas Sales Tax Holiday Calendar.

Free File Program Now Open;

Related Post: