What Is A Fiscal Calendar Year

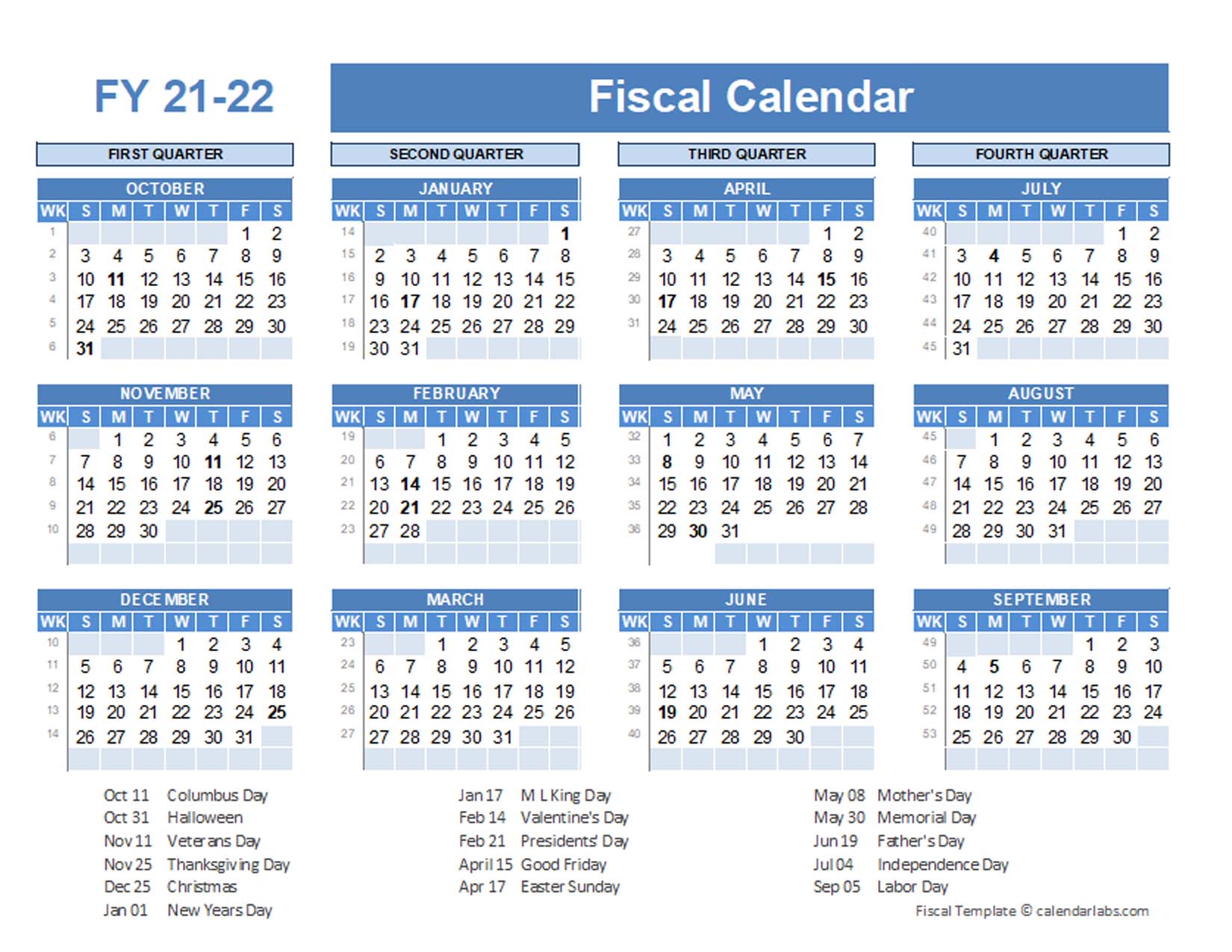

What Is A Fiscal Calendar Year - In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. A fiscal year and a calendar year are two distinct concepts used for different purposes. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. What is a fiscal year? For the fiscal first quarter ended december 31, 2024, outlook therapeutics also reported an adjusted net loss attributable to common stockholders 1 of $21.6 million, or $0.89. This decision can have tax implications,. It can be any date as long as. Fiscal calendars help companies manage their time in the way that best meets the needs of their organization. While many businesses operate on a standard 12. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. What is a fiscal year? Unlike the calendar year, which always. What is a fiscal year? This decision can have tax implications,. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the. It can be any date as long as. What is a fiscal year? A fiscal year and a calendar year are two distinct concepts used for different purposes. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. Unlike the calendar year, which always. The fiscal year is a period. What is a fiscal year? In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in. What is a fiscal year? In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. Unlike the calendar year, which always. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. The fiscal year is a period. The fiscal year is a period. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. While many businesses operate on a standard 12. Unlike the calendar year, which always. For the fiscal first quarter ended december 31, 2024, outlook therapeutics also reported an adjusted net loss attributable to common stockholders 1 of $21.6 million, or. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting, and analysis. Companies use a fiscal year to mark the start and end of their. Unlike the calendar year that. This period is designated by the calendar year in. Generally, taxpayers filing a version of form 1040 use the calendar year. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. In financial planning and accounting, the structure of a fiscal calendar plays. Generally, taxpayers filing a version of form 1040 use the calendar year. It is used by companies, government bodies, educational institutions, etc., for accounting, reporting, and budgeting purposes. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,. In financial planning and accounting, the structure of a fiscal calendar plays a crucial role in reporting, forecasting,. The irs distinguishes a fiscal year as separate from. What is a fiscal year? An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the. It can be any date as long as. In this article, we explain what a fiscal year is, describe the. In the united states, the federal government’s fiscal year begins on october 1 and ends on september 30 of the following year. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. While many businesses operate on a standard 12. In this article,. What is the fiscal year? For the fiscal first quarter ended december 31, 2024, outlook therapeutics also reported an adjusted net loss attributable to common stockholders 1 of $21.6 million, or $0.89. In this article, we explain what a fiscal year is, describe the. A fiscal year covers a consecutive period of twelve months and is used for calculating and. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the. What is a fiscal year? It is used by companies, government bodies, educational institutions, etc., for accounting, reporting, and budgeting purposes. While many businesses operate on a standard 12. What is a fiscal year? The fiscal year is a period. What is a fiscal year? Unlike the calendar year, which always. A fiscal year covers a consecutive period of twelve months and is used for calculating and preparing financial statements for the year. In the united states, the irs allows businesses to choose a fiscal year or calendar year, provided consistency is maintained in reporting. Many companies use a fiscal year that. In this article, we explain what a fiscal year is, describe the. It can be any date as long as. This decision can have tax implications,. Unlike the calendar year that starts on january 1 and ends on december 31, a fiscal year can start and end at any point during the year. Trustees must submit form 1128, detailing the trust’s current tax year, proposed fiscal year,.Calendar Year To Fiscal Year Calculator 2024 Calendar 2024 Ireland

What Is Fiscal Year And Calendar Year Cass Maryjo

2023 Fiscal Year Calendar Printable Calendars AT A GLANCE

What Is A Fiscal Year Vs Calendar Year Ryann Florence

Fiscal Year Definition for Business Bookkeeping

How to Convert a Date into Fiscal Year ExcelNotes

FREE 8+ Sample Fiscal Calendar Templates in Excel PDF

Fiscal Year What It Is and Advantages Over Calendar Year

Fiscal Year Vs Calendar Year What's Best for Your Business?

In The United States, The Federal Government’s Fiscal Year Begins On October 1 And Ends On September 30 Of The Following Year.

In Financial Planning And Accounting, The Structure Of A Fiscal Calendar Plays A Crucial Role In Reporting, Forecasting, And Analysis.

For The Fiscal First Quarter Ended December 31, 2024, Outlook Therapeutics Also Reported An Adjusted Net Loss Attributable To Common Stockholders 1 Of $21.6 Million, Or $0.89.

A Fiscal Year And A Calendar Year Are Two Distinct Concepts Used For Different Purposes.

Related Post:

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)