What Is Calendar Spread

What Is Calendar Spread - In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. Calendar spreads combine buying and selling two contracts with different expiration dates. Traders have access to several different types of debit spreads when implementing their options strategies. Spreads in forex are the difference between the bid and ask price of a currency pair. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. What is a calendar spread? A calendar spread is an options trading strategy in which you enter a long or short position in the stock with the same strike price but different expiration. What is a debit spread how to trade it. You can go either long or. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. A calendar spread strategy involves holding positions in derivative contracts of different expiries to reduce margin requirements. A calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different delivery dates. These individual purchases, known as the legs of the spread, vary only in expiration date; Spreads in forex are the difference between the bid and ask price of a currency pair. What is a debit spread how to trade it. This approach allows speculation on the forward curve, representing. Major currency pairs tend to have tighter spreads than exotic pairs which may have a wider. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. These individual purchases, known as the legs of the spread, vary only in expiration date; Until now, traders benefited from lower margin requirements. A calendar spread is a trading strategy that involves simultaneously buying and selling an options or. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates. What is a calendar spread? These individual purchases, known as the legs of the spread, vary only in expiration date; A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset. What is a calendar spread? What is a debit spread how to trade it. A calendar spread strategy involves holding positions in derivative contracts of different expiries to reduce margin requirements. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is a trading strategy that. What is a calendar spread? They are based on the same underlying market and strike price. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates.. Spreads in forex are the difference between the bid and ask price of a currency pair. You can go either long or. These individual purchases, known as the legs of the spread, vary only in expiration date; Major currency pairs tend to have tighter spreads than exotic pairs which may have a wider. A calendar spread is a trading strategy. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates. They are based on the same underlying market and strike price. These individual purchases, known as the legs of the spread, vary only in expiration date; A calendar spread is an options trading strategy in which you. You can go either long or. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Traders have access to several different types of debit spreads when implementing their options strategies. Calendar spreads combine buying and selling two contracts with different expiration dates. This approach allows speculation on the. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. Traders have access to several different types of debit spreads when implementing their options strategies. A diagonal spread allows option traders to collect. These individual purchases, known as the legs of the spread, vary only in expiration date;. A calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different delivery dates. In a calendar spread, traders focus on the price differential between contracts with different delivery months. A calendar spread is a trading strategy that involves simultaneously buying and selling an options or futures contract at. A calendar spread is an options strategy that involves simultaneously entering a long and short position on the same underlying asset with different delivery dates. Calendar spreads combine buying and selling two contracts with different expiration dates. What is a debit spread how to trade it. Traders have access to several different types of debit spreads when implementing their options. Calendar spreads combine buying and selling two contracts with different expiration dates. A diagonal spread allows option traders to collect. What is a calendar spread? With calendar spreads, time decay is your friend. This approach allows speculation on the forward curve, representing. Traders have access to several different types of debit spreads when implementing their options strategies. A calendar spread is an options trading strategy that involves buying and selling options with the same strike price but different expiration dates. What is a calendar spread? Until now, traders benefited from lower margin requirements. A calendar spread involves purchasing and selling derivatives contracts with the same underlying asset at the same time and price, but different expirations. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Spreads in forex are the difference between the bid and ask price of a currency pair. You can go either long or. A calendar spread in f&o trading involves taking opposite positions in contracts of the same underlying asset but with different expiry dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is a trading strategy that involves simultaneously buying and selling an options or futures contract at the same strike price but with different expiration dates.What are Calendar Spread and Double Calendar Spread Strategies

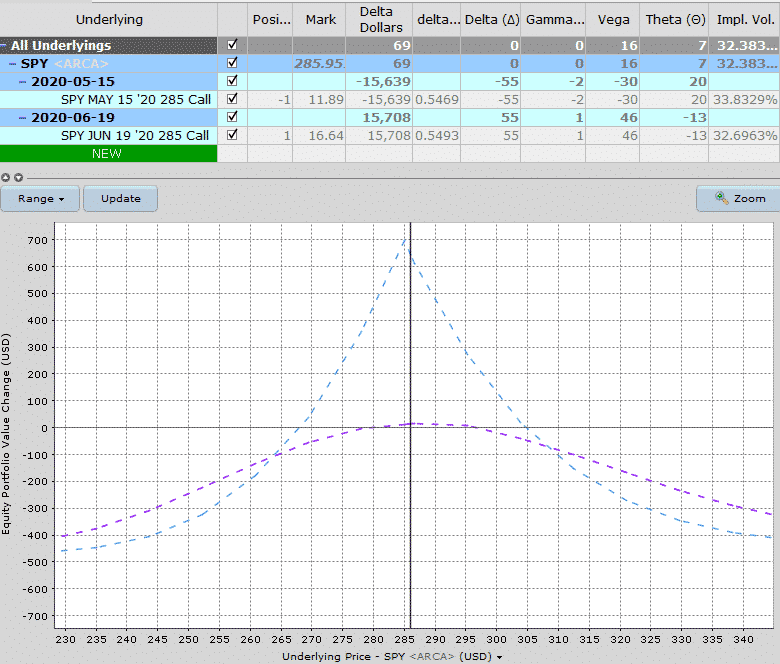

How Calendar Spreads Work (Best Explanation) projectoption

Everything You Need to Know about Calendar Spreads

Calendar Spreads 101 Everything You Need To Know

What Is A Calendar Spread Option Strategy Mab Millicent

What is Calendar Spread Options Strategy ? Different types of Calendar

What Is Calendar Spread Option Strategy Manya Ruperta

What is a Calendar Spread?

Long Calendar Spreads Unofficed

What Is A Calendar Spread Option Strategy Mab Millicent

In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The Simultaneous Purchase Of Futures Or Options Expiring On A Particular Date And The Sale Of The Same Instrument Expiring On Another Date.

A Calendar Spread Strategy Involves Holding Positions In Derivative Contracts Of Different Expiries To Reduce Margin Requirements.

What Is A Debit Spread How To Trade It.

In A Calendar Spread, Traders Focus On The Price Differential Between Contracts With Different Delivery Months.

Related Post: