Calendar Option

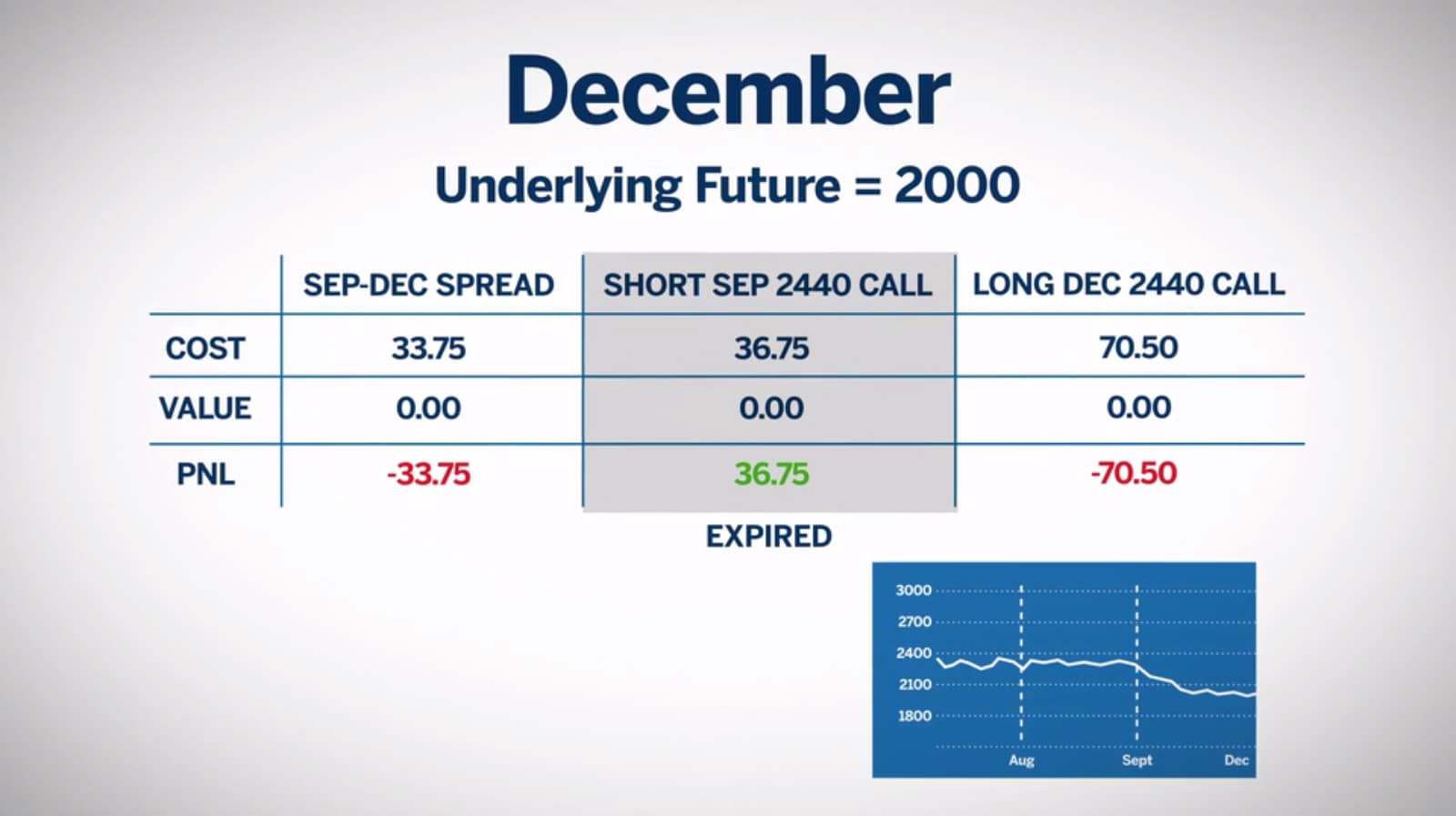

Calendar Option - Under the terms of the agreement, xilio will receive $52.0 million in total upfront payments, including a $10.0m equity investment, and will be eligible to receive up to. Crossing session orders will be accepted beginning at 1:00 p.m. Here are some examples of how calendar spread options strategy can be used in trading: Click ok to close the. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is an options trading strategy. You can go either long or. The new calendar offers several new views and navigation options: 27 for taxpayers in 25 states. Select more options > calendar settings to change your calendar appearance, adjust event and meeting settings, and more. On this website you can find our printable calendar selection which includes monthly and yearly calendars available to download for free as pdf files. You can go either long or. * each market will close early at 1:00 p.m. Finally individual investors can receive education in the art of selling options. Utilizing the features in the calendar options, you can establish meeting rules and preferences, ensuring that your schedule reflects your productivity patterns. Direct file available starting jan. The new calendar offers several new views and navigation options: 27 for taxpayers in 25 states. Here are some examples of how calendar spread options strategy can be used in trading: Select more options > calendar settings to change your calendar appearance, adjust event and meeting settings, and more. If you're searching the perfect 2025. 27 for taxpayers in 25 states. You can go either long or. * each market will close early at 1:00 p.m. In the excel options dialog box, select customize ribbon. Here are some examples of how calendar spread options strategy can be used in trading: Free file program now open; Crossing session orders will be accepted beginning at 1:00 p.m. Direct file available starting jan. Select more options > calendar settings to change your calendar appearance, adjust event and meeting settings, and more. In the excel options dialog box, select customize ribbon. Utilizing the features in the calendar options, you can establish meeting rules and preferences, ensuring that your schedule reflects your productivity patterns. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. You. To learn more, see customize your calendar in microsoft teams. The calendar spread, also known as the time spread is a favorite strategy of many option traders,. Free file program now open; A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates.. A calendar spread is a strategy used in options and futures trading: The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with. Washington — the internal revenue service today. For those willing to invest time in identifying mispriced forward volatility,. Here are some examples of how calendar spread options strategy can be used in trading: Crossing session orders will be accepted beginning at 1:00 p.m. With calendar spreads, time decay is your friend. A calendar spread is a strategy used in options and futures trading: Calendar spreads can be used as a directionally neutral strategy in options trading. A calendar spread is an options trading strategy. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. You can go either long or. Under main tabs, check the box next to developer. Direct file available starting jan. Select more options > calendar settings to change your calendar appearance, adjust event and meeting settings, and more. Direct file available starting jan. 27 for taxpayers in 25 states. * each market will close early at 1:00 p.m. A calendar spread is an options trading strategy. Utilizing the features in the calendar options, you can establish meeting rules and preferences, ensuring that your schedule reflects your productivity patterns. Under the terms of the agreement, xilio will receive $52.0 million in total upfront payments, including a $10.0m equity investment, and will be eligible to receive up to. For those willing to invest time in identifying mispriced forward. For eligible options) on thursday, july 3, 2025. Under the terms of the agreement, xilio will receive $52.0 million in total upfront payments, including a $10.0m equity investment, and will be eligible to receive up to. Here are some examples of how calendar spread options strategy can be used in trading: Finally individual investors can receive education in the art. In this episode, i walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low iv. Washington — the internal revenue service today. It offers reduced risk compared to other strategies and potential lower initial investment costs. Select more options > calendar settings to change your calendar appearance, adjust event and meeting settings, and more. View your calendar by month, a highly requested feature,. Finally individual investors can receive education in the art of selling options. With calendar spreads, time decay is your friend. Direct file available starting jan. Free file program now open; A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Calendar spreads combine buying and selling two contracts with different expiration dates. You can go either long or. For eligible options) on thursday, july 3, 2025. The calendar spread, also known as the time spread is a favorite strategy of many option traders,. On this website you can find our printable calendar selection which includes monthly and yearly calendars available to download for free as pdf files. Under the terms of the agreement, xilio will receive $52.0 million in total upfront payments, including a $10.0m equity investment, and will be eligible to receive up to.What Is A Calendar Spread Option Strategy Mab Millicent

Calendar Spread Options Strategy VantagePoint

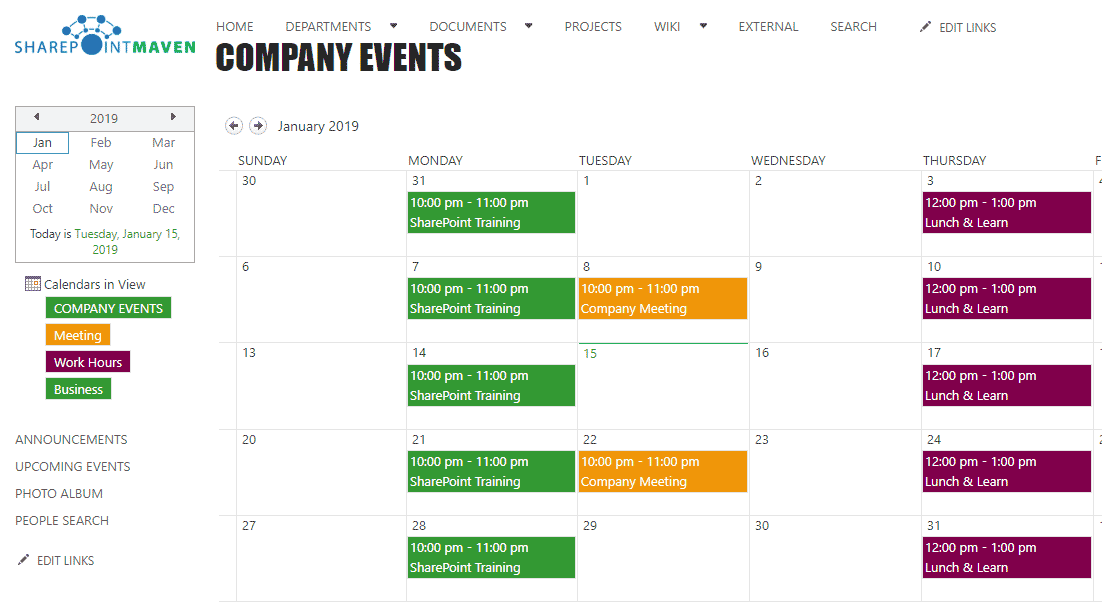

Calendar Options, what you want to see, how you want to see it

What Is Calendar Spread Option Strategy Manya Ruperta

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

A review of all the calendar options in SharePoint and Office 365

Calendar Straddle An advanced Neutral Options Trading Strategy

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Calendar Spread Options Trading Strategy In Python

Calendar Spread Margin Norah Annelise

Under Main Tabs, Check The Box Next To Developer.

The Calendar Spread Options Strategy Is A Market Neutral Strategy For Seasoned Options Traders That Expect Different Levels Of Volatility In The Underlying Stock At Varying Points In Time, With.

In The Excel Options Dialog Box, Select Customize Ribbon.

Here Are Some Examples Of How Calendar Spread Options Strategy Can Be Used In Trading:

Related Post: